Turkey first quarter GDP for 2020 increased 4.5% y/y

- Seasonally and calendar adjusted GDP increased by 0.6% compared with the previous quarter. The impact of the Covid 19 pandemic was limited in the first quarter. The growth was driven by private consumption and government spending, which rose by 5.1% and 6.2% y/y, respectively. In June, Turkey manufacturing PMI (seasonally adjusted) rises from 40.9 to 53.9, above again the critical threshold 50 since February. June PMI indicates that three month slowdown period has ended thanks to easing of restrictions related with corona virus.

- Industrial production decreased by 31 4 on an annual basis, decreased by 30.4% m/m.

- 2020 May budget posted TRY 17.3 bn deficit vs 12.1 bn deficit in 2019 May. In January May period, total budget deficit reached TRY 90.1 bn vs TRY 66.5 bn in the previous year.

- FX adjusted y/y loan growth for total banking sector has reached 18.8 y/y in June. Public deposit banks’ loan growth was 28.9% and private sector’s was at 11%. Commercial credits increased 15% whereas consumer credits increased 43.8% y/y.

- The current account balance posted a deficit of USD 5.1 bn in April 2020 and the 12 month current account turned to USD 3.3 bn in deficit ..(previous month: USD 1.3 bn annual surplus). May and June foreign trade data (USD 3.4 and 2.8 billion trade deficit) indicates May and June current account would post deficits. We expect current account deficit to widen in upcoming months (USD 23.4 bn compared to USD 8.7 bn surplus in 2019.

- Turkey June CPI came in at 113% m/m above market consensus 0.6% and 12 month rate increased sharply from 11.39% to 12.62%. Transportation made 67 pp contribution to monthly inflation. We revised our 2020 year end inflation forecast from 7.5% to 9.5% based on increasing trend in core inflation indicators.

- The Central Bank kept the interest rates unchanged despite the market’s 25 basis points interest rate cut expectation. We think that CBRT may stop for a while in cutting rates, until a downward trend is seen in inflation indicators and there will be a measured cut at policy rate. So we keep our 8% year end policy rate forecast.

- Total foreign exchange deposit accounts reached USD 202.3 bn (excluding non residents’ FX and banks’ FX deposits to other banks). The ratio of foreign exchange deposits to total deposits is 50% as of June 26.

Slowdown period has ended in manufacturing activity

In June Turkey manufacturing PMI (seasonally adjusted) rises from 40.9 to 53.9 above again the critical threshold 50 since February. June PMI indicates that three month slowdown period has ended thanks to easing of restrictions related with corona virus

Industrial production decreased by 31.4% on an annual basis, and by 30.4% m/m. The highest monthly decrease was in the production of durable goods with 49.3%. Capital goods production decreased by 42.9% m/m, non-durable consumer goods production by 31.5%, energy production by 15.6% and intermediate goods by 27%. June PMI data indicate that industrial production will start to recover in June.

2020 May budget posted TRY 17.3 bn deficit vs 12.1 bn deficit in 2019 May

•In January May period, total budget deficit reached TRY 90.1 bn vs TRY 66.5 bn in the previous year.

• In May, budget revenues decreased by 4.8% y/y and expenditures increased by 22% y/y.

• Tax on imports decreased by 30.9% y/y since imports sharply decreased in May.

- Interest expenditures increased by 21.85 y/y

• Budget deficit will continue to widen from now on due to Covid 19 spending measures.

•2020 budget program projected TRY 139 bn deficit and 2.9% budget deficit/GDP ratio. In May, budget deficit /GDP ratio reached 3.3%.

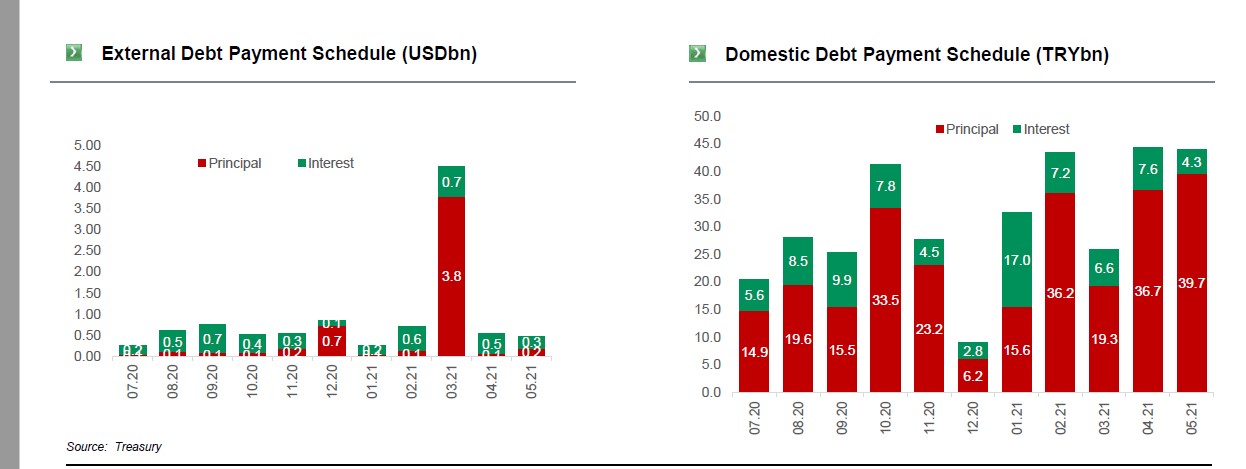

- Treasury has to pay TRY 164.4 bn of domestic debt for the rest of 2020. In addition to the increasing debt burden due to the rise in interest rates, Treasury’s maturity shortening in borrowings seems to have led to a substantial payment schedule in 2021.

- Borrowing program released by Turkish treasury indicates a 104% domestic rollover ratio in 2020 vs 93% in 2019. External rollover ratio is expected to rise to 88% in 2020 from 75% in 2019.

- In June 2020 Treasury borrowed TRY 66 bn from the domestic market compared to TRY 20 bn redemption. Year to date, domestic rollover ratio (incl interest) reached 155%. We expect high roll over ratios going forward, due to measures to limit the economic impact of Covid pandemic. Treasury has a total debt of 354.6 billion TL, which must be paid by May next year.

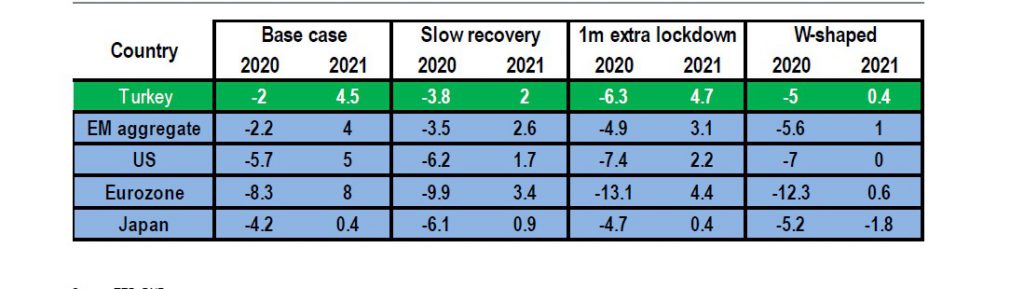

Scenarios for growth under lockdown era

BNP economists have studied various scenarios under different lockdown scenarios for Covid 19 Though health conditions and economic structures differ across countries, we can summarize assumptions behind the scenarios as follows

Base case: Eight weeks of lockdown on average, business and household sentiment rebounds once shock fades,

Slow recovery: Eight weeks of lockdown on average, businesses and households remain relatively cautious for longer than under our base case,

1 month extra lockdown: Twelve weeks of lockdown on average, Businesses and households remain relatively cautious for longer than in our base case,

W Shaped recovery: We assume in this scenario that after measures are lifted, the virus re-emerges in the autumn. Businesses and households remain relatively cautious for longer than under our base case. Total of 14 weeks of lockdown throughout the year.

Excerpt only

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/