According to Gedik Investment analysis, the most important changes in the December balance of payments data were in the capital item. Turkish citizens and corporates purchased large amounts of Treasury and banks’ foreign currency bonds. The methodological change by Central Bank (CBRT) presents a completely news picture of how Turkey finances itself. It appears a lot of FZ debt issuance has been bought with Turkish funds!

However, banks are very good at providing net external financing. Although the current account deficit will increase in 2025, it will remain low.

Gedik Invest chief economist Serkan Gonencler writes:

The current account (C/A) deficit exceeds expectations at USD4.65bn in December.

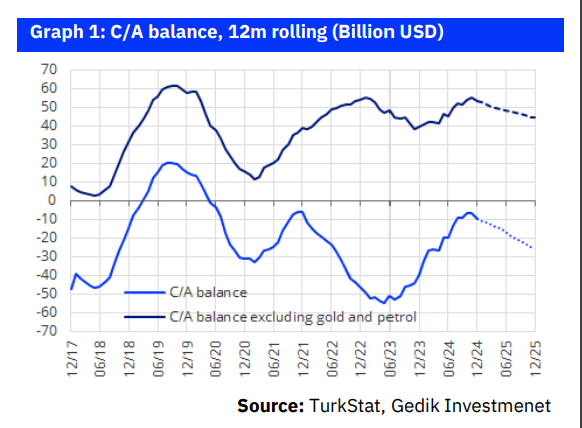

The current account deficit came in at USD4.65bn in December, surpassing the median market expectation of USD4.1bn and our forecast of USD4.2bn. As a result, the 12-month rolling deficit widened from USD7.0bn to USD10.0bn (equivalent to 0.7% of GDP), closing 2024 at this level. When the current account deficit peaked at USD56bn in May 2023, it corresponded to approximately 5.5% of GDP at the time.

CBRT’s methodology change indicates that banks’ Eurobond issuances were absorbed by domestic investors in 2024

The CBRT has introduced a significant methodological change regarding the reporting of securities issuances (Eurobonds) under the Portfolio Investments category. According to the CBRT, the new approach reflects only the non-residents’ net purchases of domestically issued securities and, conversely, only the residents’ net purchases of debt securities issued by non-residents.

Following this change, a notable decline is observed in banks’ net Eurobond issuances, in particular. Prior to the adjustment, banks’ net Eurobond issuance stood at USD14.0bn for the first 11 months of 2024 (as of November). However, post-adjustment, this figure was revised down to USD3.2bn.

In other words, out of the USD14.0bn in net Eurobond issuances by banks between January and November, only USD3.2bn was purchased by non-residents, with the majority being absorbed by domestic investors. With this revision, net Eurobond issuance figures were also adjusted for corporates (from USD4.9bn to USD3.7bn) and for the Treasury (from USD2.7bn to USD0.7bn). Similarly, residents’ net purchases of foreign securities by dropped from USD23.4bn to USD8.7bn. Despite these adjustments, banks’ external borrowing remains the primary source of financing in 2024, as banks seem to have secured USD28.2bn in funding through USD25.0bn in loan-based borrowing and USD3.2bn in Eurobond issuances.

The breakdown of the Treasury’s Eurobond purchases over the past few years suggests a shift in investor composition in favor of non-residents

Using the adjusted methodology, the historical allocation of the Treasury’s Eurobond issuances between domestic and foreign investors can be derived.

According to these figures, while domestic investors were the primary buyers in 2021 and 2022, foreign investors have dominated purchases over the last two years. For instance, in 2021, domestic investors purchased USD7.9bn of the USD10bn in total Eurobond issuance. In contrast, in 2024, out of USD11.1bn in issuance, USD9.1bn was acquired by foreign investors.

C/A deficit expected to stabilize at 1.5%-2.0% of GDP in 2025

The deterioration in the C/A balance, which started in November, became more pronounced in December, as anticipated. We expect the widening trend to continue into 2025 due to the acceleration in imports and the fading of favorable base effects. Nevertheless, we project the C/A deficit to remain at a manageable level, within 1.5%-2.0% of GDP throughout the year. Our yearend forecast for the 2025 current account deficit stands at USD25bn (1.5% of GDP).

İs Yatirim: Manageable CA deficits to prevail in 2025

Is Yatirim analysts commented on BOP, too: Following the January foreign trade data, we increased our 2025 current account deficit forecast by 2 billion dollars to 21 billion dollars (1.4% of the estimated national income). Global trade wars, additional slowdown in the European economy and the possibility of F-16 imports from the USA continue to pose an upside risk on this figure. Even in such a scenario, we would not expect external financing problems or a big jump in the dollar exchange rate. On the other hand, the possibility of peace on the Russia-Ukraine front after the US initiative may positively affect the current account balance by suppressing oil prices.

IMPORTANT DİSCLOSURE: PA Turkey intends to inform Turkey watchers with diverse views and opinions. Articles in our website may not necessarily represent the view of our editorial board or count as endorsement.

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/