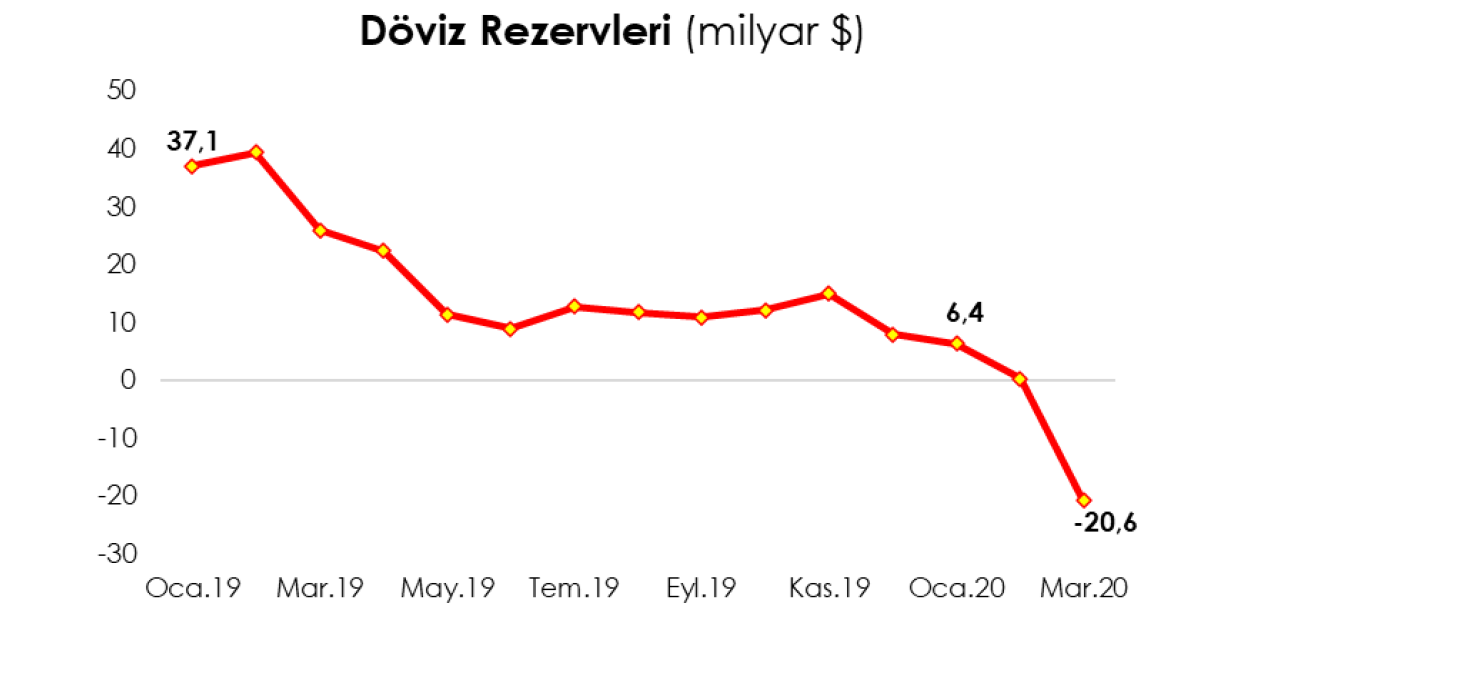

Brad Setser: Why Turkey is running out of FX?

tcmb-net rezerv-nisan

tcmb-net rezerv-nisan

(Cover chart: Central Bank net reserves)

Turkey’s currency has suddenly toppled versus the dollar, falling as low as 7.15 on Wednesday noon, not far off from its all-time low of 7.24 recorded during the Father Brunson crisis in August 2018. Many Turkey watchers don’t understand the weakness of the currency, given Turkey has very little current account deficits and its Central Bank over $90 bn in FX reserves. Moreover, Turkish savers keep most of their deposits in FX, hence banks ought to be awash in liquidity. Brad Setser of Council of Foreign Relations provides a masterly analysis of how banks conduct business and how their balance sheets are linked to that of the Central Bank to solve the puzzle. His conclusion is alarming, but shared with several investment banks, such as Toronto Dominion securities and the financial press. Below are excerpts from Brad Setser’s research article “Turkey Shows the Value of Balance Sheet Analysis”.

The great financial puzzle posed by Turkey is why, given the strong domestic foreign currency deposit base of the Turkey’s banks, they nonetheless went out and borrowed a lot of foreign currency. The banks account for around $150 billion of Turkey’s $450 billion in external debt.

The magic that makes Turkey’s financial system work has long been the foreign currency swap market.

The availability of swaps basically explains why the banks borrowed foreign currency abroad that they didn’t appear to need to cover their domestic foreign currency lending.

Turkey’s banks have long had difficulty getting long-term deposits from domestic depositors residents. But my borrowing foreign currency for longer tenors abroad and swapping it into lira, the banks created (synthetic) long-term lira financing to help match their longer-term lira lending. And the CBRT also helped the banks lend more in lira when it allowed the banks to meet a portion of their Turkish lira reserve requirement by holding foreign currency at the central bank.

More lira lending raised the banks’ profits back when times were good. And it the reserve option mechanism helped the central bank out too, as the foreign exchange the banks put on deposit at the CBRT counted toward Turkey’s reported foreign exchange reserves.

Turkey’s banks are thus simultaneously a source of short-term strength for Turkey, as they are still in a position where they can lend some of their excess domestic foreign currency deposits to the central bank to help the central bank out, and a medium term vulnerability—as the banks will eventually need some of their surplus foreign currency to pay back their external creditors.

All this matters now, as the CBRT has been intervening (selling dollars through the state banks) very heavily in the foreign exchange market.

And it is increasingly intervening with foreign exchange borrowed from the banks.

We know this because the central bank reports its net reserves, and those have been falling.

And we know this because the central bank reports its “swaps” position—swaps in this case are the mechanism through which the banks get lira from the central bank and the central bank gets foreign exchange from the banks. Those swaps boost the central bank’s reported reserves, but they don’t have to enter into the accounting as borrowed reserves.

Those swaps reached just under $30 billion at the end of March. And that in turn implies that all of the central bank’s reported net reserves at the end of March are in effect borrowed reserves, as the swap are an off balance sheet form of borrowing. And the central bank has continued to sell —and in all probability, has only increased the amount it borrows from the banks via the swaps.

The central bank unleashed a wave of regulatory changes that more or less forces the banks to provide more foreign currency to the central bank in April. Swaps with offshore counter-parties have more or less been prohibited (they are now limited to 1 percent of the bank’s capital base). And the regulatory limit on the banks’ swaps with the central bank was just increased.

What’s the risk here?

Well, Turkey’s banks should still be liquid in foreign currency as they have way more foreign currency deposits than they have domestic foreign currency loans (a lot of those loans are bad, but that’s another story). Some of that excess foreign currency funding has been invested in Turkey’s foreign currency denominated bonds, but a lot should be in liquid foreign exchange deposits—both abroad and at the central bank.

But, well, if the banks have put foreign exchange on deposit at the CBRT and the CBRT has sold the foreign exchange into the market, well, then the foreign exchange isn’t really there—the banks’ foreign currency exposure to the CBRT thus starts to become a risk.

And that risk will become more acute if, as is likely, the syndicated bank loans that are coming due over the next few months aren’t rolled over—or at least aren’t rolled over at a high rate, and the banking system’s remaining liquid foreign exchange buffer is drawn down.

Right now, the banks and the central bank are basically sharing the same pool of reserves—so the loss of reserves by either banks (as external loans roll-off) or the central bank (through ongoing foreign exchange sales) hurts both. The CBRT’s FX sales thus pose an increasing risk to the banking system. That is what the balance sheet inter-linkages tell us.

In the process, Turkey has become a growing global financial risk. Neither the CBRT nor the banking system is yet out of foreign exchange. But Turkey will eventually run out on its current trajectory.