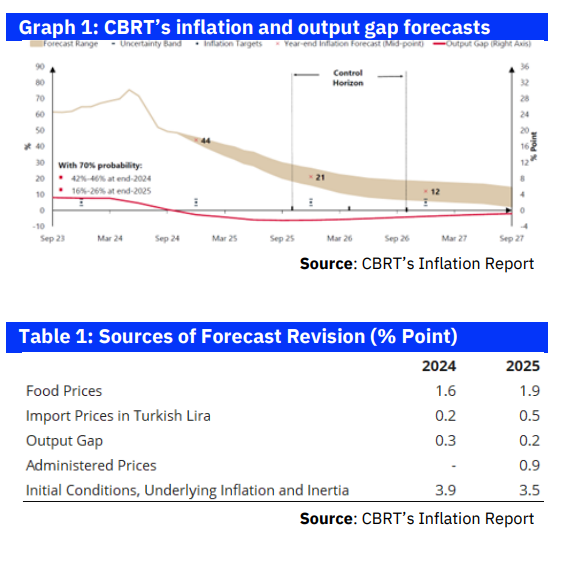

CBRT made sizeable upward revisions to its inflation forecasts. The CBRT’s revised 3-year CPI inflation interval projections are as below

CBRT Governor reveals that the underlying inflation trend has remained higher than their projections. The revised estimates are also higher than the recent Medium-Term-Program (MTP) projections of 41.5%, 17.5%, and 9.7%. In fact, these revisions do not come as a surprise to us, as the 10-month cumulative inflation has already reached 40%, so meeting the MTP target for 2024 was out of reach. In our October inflation review report, we had already shared our expectation of a revision to 43.0-43.5% levels.

CBRT Governor Fatih Karahan clarified that the underlying inflation trend has remained higher than their expectations, which was the main culprit behind the revisions, along with higher food prices (which is beyond the CBRT’s control as specified by Karahan.

Despite these upward revisions, CBRT Governor Fatih Karahan struck a notably dovish tone, bolstering expectations for a near-term rate cut.

Karahan emphasized that the substantial revisions would not affect the Bank’s policy course, attributing the recent inflation forecast miss largely to external factors beyond the monetary policy control, such as surging rental and food inflation. Additionally, he noted that, excluding rental pressures, services inflation has seen significant moderation—a view with which we are somewhat cautious. In our assessment, these dovish messages seem aimed at preparing markets for an upcoming rate-cut cycle, a prospect that has indeed strengthened rate-cut expectations, as evidenced by the stock market’s rebound.

The CBRT may be considering a total rate cut of around 750-1000 basis points by April.

Governor Karahan disclosed that the Bank expects CPI inflation to ease to 38% by March, reflecting a three-month delay in achieving the previously projected end-2024 inflation target. Karahan suggested this delay should not pose significant issues for the disinflation process, which is another dovish signal, in our view. Despite these dovish messages, the CBRT remains also committed to sustaining a tight monetary policy stance.

To uphold the policy tightness, we believe the policy rate should target an ex-post real rate of approximately 300-500 basis points, at least in the initial stages of the rate cut cycle. Given the CBRT’s forecast of 38% CPI inflation by March, we sense that the Bank may be positioning itself for a rate-cut cycle totaling around 750-1000 basis points by April. Nonetheless, it remains uncertain whether inflation will align with the CBRT’s projections.

Serkan Gonencler, Chief Economist, Gedik Invest

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/