Turkey’s central bank could revise its forecast higher in its new inflation report, due to be announced this week, claims Daily SABAH.

The Central Bank of the Republic of Turkey (CBRT) will publish its fourth and last quarterly inflation report for this year in a briefing expected to be held in the capital Ankara on Thursday. The Bank usually revises its inflation forecast and views on growth and current account deficit in the quarterly report.

Annual headline inflation rose to 19.58% in September, its highest level in two and a half years, with food inflation near 29%. The core “C” measure – which the central bank has been stressing lately – rose to near 17%.

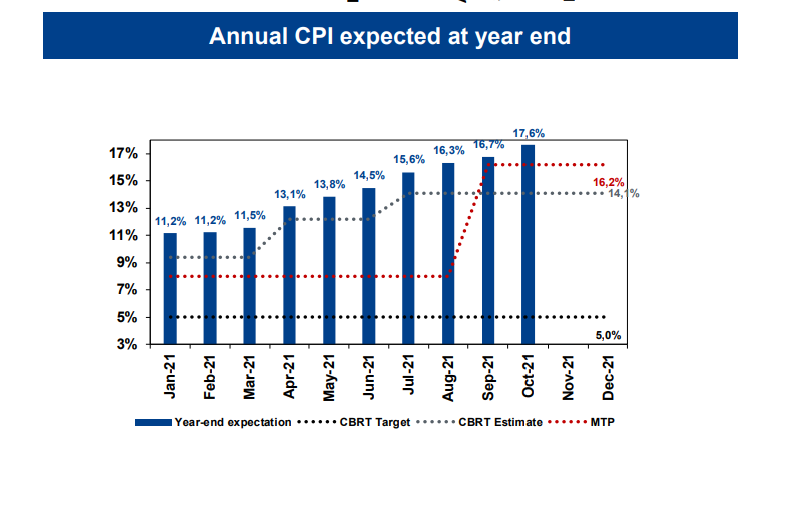

In CBRT’s monthly poll of economic expectations, CPI expectations continued to deteriorate for all terms. Year-end CPI expectation reached 17.63%, up by 89bps MoM and expectations for 12-month ahead increased by 97bps to 13.91. Additionally, expectations for 24-month ahead continued to stay at double-digit levels for the 5th consecutive month by 11.27%, up by 56bps. Also, expectations for 5-year ahead continued to deteriorate for the 9th month in a row with 7.93%, up by 8bps.

Expectations of USDTRY currency for the year-end increased by 3.4% to 9.22 and 12-month ahead increased by 4.7% to 10.01.

Analysts have suggested CBRT’s year-end inflation forecast of 14.1%, according to its previous quarterly report, could be revised upwards.

The country’s medium-term economic program, announced last month, expects it to fall to 16.2% by the end of the year and hit 9.8% by the end of 2022.

The bank forecast the end-2022 inflation at 7.8% and expects it to hit 5% in 2023.

WATCH: Turkey’s Annus Horribilis | Real Turkey

These targets lack reality. In his speech to introduce the draft 2022 budget, VP Fuat Oktay stated that the government’s goal is to reduce inflation to “single digits”. Two economists PA Turkey consulted expressed the view that CBRT MPC statement notwithstanding, Erdogan could order more rate cuts before the end of the year. In anticipation of Erdogan’s wishes, CBRT may refrain from upping its inflation forecasts.

WATCH: How Bad is Fed Taper for Turkish Assets?

The report comes after the central bank surprised markets again last week by slashing its policy rate by 200 basis points, twice as much as expected, to 16%. It had surprised last month with a 100-point cut.

It said there would be little room for more rate cuts this year given what it called transitory price pressure on food, energy and other imports.

Independent research reveals that at least 25% of inflation has become “sticky”, driven by low credibility of CBRT and government’s visible reluctance to sacrifice any GDP Growth to stem higher prices.

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng