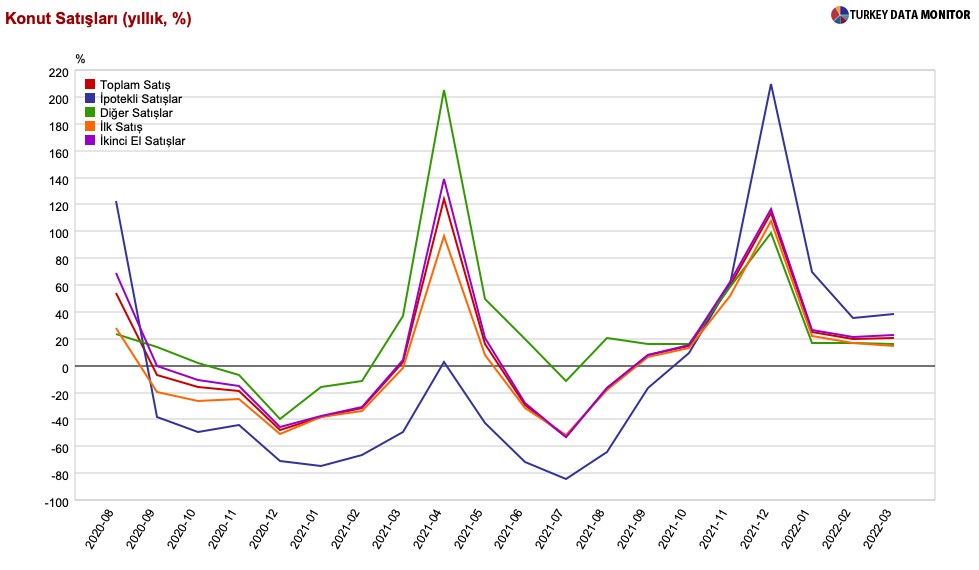

Cover chart: House sales. Red = total

Blue= mortgage Orange = new home sales Violet: Second home sales

Residential property sales to foreign citizens increased by 31 percent in March compared to the same month last year, according to figures released by the Turkish Statistical Institute (TurkStat). Total March home sales, including second sales amounted to 134,170 units, rising 21% YoY and 37.5% MoM.

Cheap credit stokes house sales

According to latest Central Bank data, simple annualized mortgage rates are 19% for prime buyers, compared to 61% YoY CPI, and 12-mth expectation of 40-50%, based on research source.

Economist PATurkey interviewed on the subject claim that there is increasing re-allocation of wealth from financial to real assets led by property.

Construction apparently didn’t keep up with rising demand, because of soaring costs, estimated at 90% for materials and 150% for land. REIDIN’S new home price index rose by 13% MoM in March, and 22.7% YoY, meaning most demand is destined for lower-price second hand homes, where average price increase is estimated 120% by reputable university-affiliated think-tank BETAM.

Turkish Real Estate: Worst Time to Buy! | Real Turkey

Foreign interest attracts controversy

Sales to foreigners in the first quarter of the year rose by 45.1 percent on an annual basis to 14,344, the data showed, reports biaNet.

Some 5,567 properties were sold to foreigners last month, with 2,245 sales in İstanbul, the largest city of the country. The Mediterranean resort city of Antalya followed İstanbul with 1,434 property sales and the capital of Ankara was third with 347.

Citizens of Iran bought the highest number of properties with 784 and were followed by citizens of Iraq 741 sales and of Russia with 547 sales.

Rising share of foreign purchases triggered a loud outcry in social media about non-residents driving up prices. Real estate agents floated news of thousands of rich Russian and Ukrainian citizens rushing to buy Turkish real estate, which is not confirmed by data.

Turkey grants citizenship to foreigners who buy a residential property worth 250,000 US dollars in the country. After a cabinet meeting on Wednesday (April 13), the government decided to increase this amount to 400,000 dollars, according to the state-run Anadolu Agency (AA).

Home ownership

Overall house sales in the country increased by 20.6 percent in March on an annual basis, according to TurkStat.

A total of 134,170 houses changed hands last month, up from 111,241 in March 2021.

Mortgaged house sales amounted to 30,271 in March, up 38.8 percent year-on-year, accounting for 22.6 percent of all sales, and attesting to cheap credit encouraging home purchases.

According to real-estate experts, savings are rapidly being deployed to the luxury segment of the market as “investments”, i.e. with a view on re-selling soon.

This views is confirmed in the biaNet article, which states: “Despite the increase in house sales, the homeownership rate in the country has significantly decreased in the past decade. It dropped from 61.1 percent in 2014 to 58.8 percent in 2019 and 57.8 percent in 2020, according to the TurkStat figures. 2021 figures have not yet been announced”.

Housing prices and rents in the country have excessively increased over the past year, more than any other country in Europe, according to Eurostat data. According to PATurkey estimates, prices adjusted by USD and cumulative CPI are rising at double-digit rates over the lats six months, raising concerns about a boom.

Three Scourges of Turkish Economy: Unemployment, Inflation, and External Deficit | Real Turkey

Turkey’s deep negative REAL rates are clearly unsustainable. Rate hikes either under the Erdogan administration, by a new government after general elections will have to be followed up by much tighter monetary policy to tame inflation. Higher real rates, even if they remain negative, are usually correlated with busts in the housing market.

Follow our English language YouTube videos @ REAL TURKEY:

https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng