In a report released today, Citi stated that Turkey has exhibited a stronger performance than expected this year but anticipates a noticeable slowdown in economic activity in 2024.

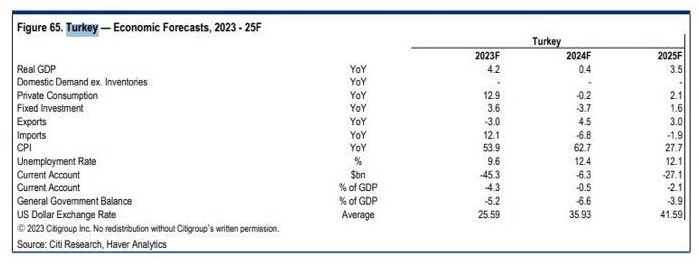

Citi predicts that GDP growth will slow down due to tighter financial conditions. The bank’s forecast GDP forecast for 2023 is 4.2% which is expected to decelerate to 0.4% in 2024. The growth expectation for 2025 is set at 3.5%.

Citi also forecasted that the Consumer Price Index (CPI) in Turkey, which is expected to be 53.9% this year, will rise to 62.7% in 2024 and slow down to 27.7% in 2025.

The unemployment rate is projected to be 9.6% this year, increasing to 12.4% in 2024 and then slightly decreasing to 12.1% in 2025. As for the USD-TRY exchange rate, Citi’s forecast is an average of 35.93 for 2024 and 41.59 for 2025. The average for this year is estimated to be 25.99.

The bank wrote:

“Following another year of stronger-than-expected growth performance, we look for a visible slowdown in economic activity in 2024. With the brought-forward consumption phenomenon losing steam due, inter alia, to tighter financial conditions and exports softening owing to weaker global activity, we expect GDP growth to decelerate to 0.4% in 2024 from an estimated 4.2% this year.

In our view, there is a great deal of uncertainty about the outlook in the aftermath of the March 2024 local elections. Whether the authorities will continue with the normalization/tightening process or return to unorthodox policies after the elections will play an important role in shaping investor sentiment.

While we employ the former scenario in our base case, the conflict in the Middle East and the envisaged sharp decline in economic activity could complicate the already challenging outlook.

Moreover, projected at around 6.5% of GDP in 2024, a relatively wide budget deficit leaves limited policy space for the authorities to counter adverse shocks.

Notwithstanding foreign investors’ low exposure to Turkish assets, we believe that the noted difficult backdrop, low macroeconomic visibility and large external financing requirements point to a challenging outlook for the currency and bonds.”