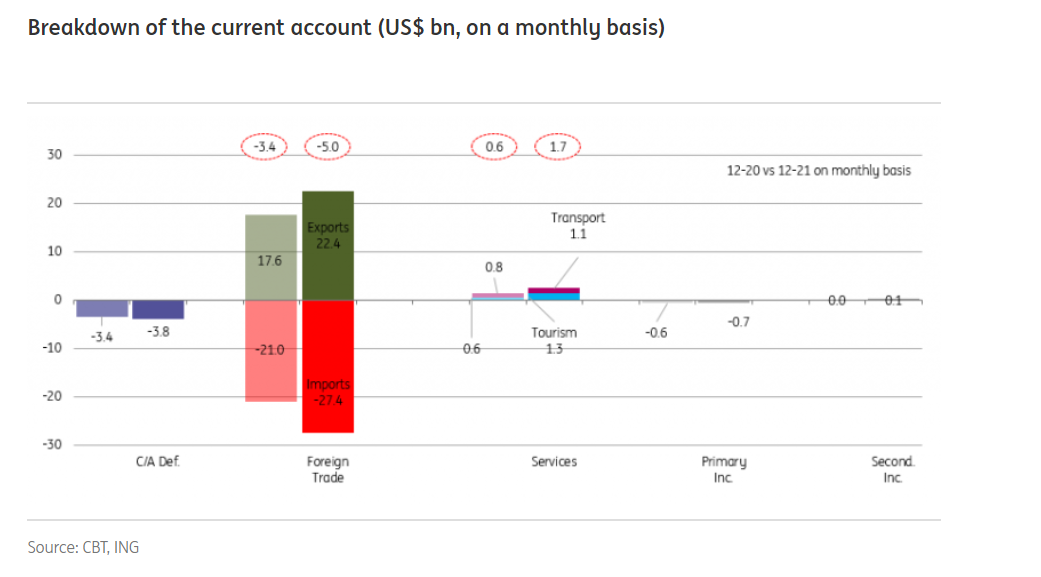

Turkey’s current account recorded a deficit of US$3.8bn in December, which is up from the US$3.4bn deficit recorded in the same month of 2020. The major item responsible for the widening in the monthly deficit was the spike in energy imports amid higher oil and natural gas prices, while the recovery in the gold balance and services income limited the deterioration. Turkey’s new-brand new-the newest New Economy Plan relies on producing a current account surplus, which would increase inflows of hard currency into the financial system, replacing financial investments which had been leaving the country since 2018-2019, when former economy czar Berat Albayrak’s bizarre mix of economic policies destroyed confidence.

Financial services firm Yatirim Finansman commented that “net energy deficit increased by USD3.9bn YoY to USD6.2bn. Accordingly, core figures (excluding gold and energy) indicated a USD2.3bn of surplus (Dec.20: USD+700mn). On the other hand, USD 1.1bn and USD 102mn of improvements on net service revenues (USD 1.7bn) and primary and secondary deficit (USD -562mn) in year-over-year limited the monthly CA deficit”.

This is scary, it means ex-energy Turkey cut imports sharply (bad for domestic demand and future private sector fixed investment). Turkey’s terms-of-trade, too deteriorated sharply, hinting that unless global commodity prices decline rapidly, the trade deficit could enlarge despite weaker domestic growth.

On the positive side, CA deficit decreased by USD 20.7bn to USD 14.9bn (2020: USD -35.5bn) whereas core surplus increased by USD 18.2bn to USD 29.3bn in 2021 (2020: USD 11.1bn).

However, adds Yatirim Finansman “According to preliminary figures, trade deficit was USD10.4bn in January (Dec.21: USD-6.8bn, Jan.20: -3.1bn). Recent slowdown on YoY export growth deserved attention”.

Fed Interest Rate Hikes Will Hurt Turkish Economy (And Other Emerging Markets) Badly

ING research was more optimistic about 2022 outlook: The current account, which narrowed throughout 2021, showed signs of changing direction in December, with a slight increase in the deficit. Early indicators reveal that imports continue to be strong amid a surge in energy imports, hinting at a further expansion in the near term with a higher foreign trade deficit. However, export volume growth will likely remain resilient due to price effects from exchange rate movements and a recovery in global demand, while the expected moderation in domestic demand should keep imports in check.

TURKEY: Next Stop Is Currency Controls | Real Turkey

Most importantly, tourism revenues should continue to increase rapidly with easing pandemic pressures and the lira’s depreciation supporting tourism demand. Given this backdrop, the current account should remain under control this year, in our view. On the financing side, the significant reliance on net errors & omissions and recent weakness in registered flows hint at challenges in the capital account, while a less supportive global backdrop should add to these challenges in 2022.

AKP administration has laid all of its hopes for election on stabilizing the exchange rate until summer months when hopefully a buoyant tourism season will generate current account surpluses, driving the exchange rate higher. TL appreciation slows down inflation, while reducing bond yields. Polls find that a strong TL also creates an illusion of economic prosperity for citizens, potentially elevating AKP’s poll standings.

In final analysis, the AKP sadminstraiton2s increasingly heavy-handed tactics to anchor the currency until summer months with the hope that trade flows will take over the job in summer months and beyond is an extremely dangerous plan, which may or may not work. Prolonged energy rally, a bad harvest and Fed tightening causing slower foreign credit could all derail the New Economy Plan.

Follow our English language YouTube videos @ REAL TURKEY:

https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng