Deutsche Banks heralds carry trade in Turkish Lira is back

swap positions-dec12

swap positions-dec12

We turned bullish on the lira in late September on account of over delivery from authorities in the shift towards more orthodox policy, attractive carry and a belief that there was a strong incentive for authorities to keep the nominal exchange rate stable near term to meet disinflation and de-dollarization goals. While USD/TRY (USD/Turkish Lira) initially moved in line with forwards, in recent weeks it has undershot.

One of the most important bullish signals is the return of carry seeking inflows. Back in 2021 these were sufficient, with an improved current account balance, to keep USD/TRY stable for six months in spite of elevated inflation. It is difficult to precisely quantify the scale of inflows, but three pieces of evidence stand out. First, there has been a remarkable improvement in the CBT’s net reserves over recent weeks, approaching USD 11bn excluding treasury FX deposits and gold valuation effects). If the central bank had not chosen to increase its net reserves, it is likely the nominal USD/TRY exchange rate would be some way below current levels.

https://www.paturkey.com/news/turkey-scores-3-major-foreign-financing-victories-in-a-week/2023/

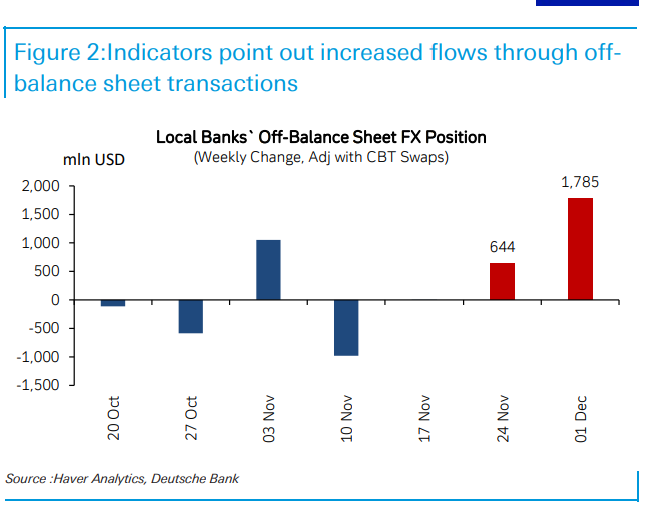

Second, local banks’ off balance sheet FX position, adjusted for CBT swaps, has shown a significant jump, historically associated with carry inflows.

Third, volumes of local banks’ FX swap transactions has markedly increased.

Importantly, while offshore positioning is building, it is still way off levels reached during previous episodes of the TRY carry trade. With levels of wider FX volatility low and other high yielding EM central banks cutting rates, this in turn suggests that carry inflows can continue to help TRY during a seasonally negative period for the

current account. Recent upside surprises to policy, including a larger than expected hike at the last CBT meeting, as well as signs of rebalancing in macroeconomic indicators, should also help.

Structurally, real valuations, especially given high inflation, and uncertainty about next year’s municipal elections, continue to present risks. In the near term, however, authorities deserve credit for a careful balancing of priorities between disinflation, FX and reducing the share of KKM deposits. Another positive catalyst would be relaxing restrictions on local banks’ offshore swaps exposure, hinted at recently by the Finance Minister.

Restrictions have driven the cross currency basis negative as local banks have run up against their limits due to onshore demand, in turn reducing the attractiveness of TRY implied yields. A further increase in rates at next week’s meeting would be another positive for the trade.

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/