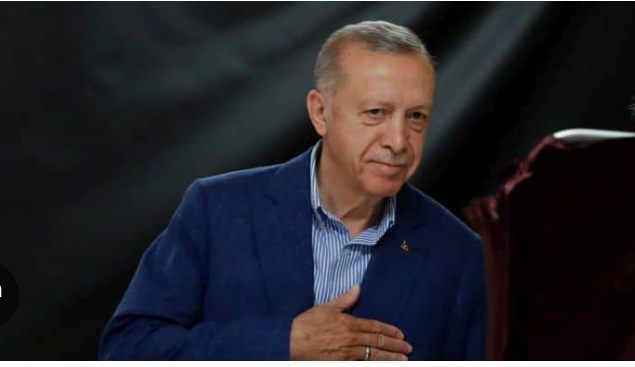

Turkey’s President Recep Tayyip Erdogan said interest rates will fall in 2025 as he once again stated his unconventional belief that lowering interest rates will slow down price increases, Bloomberg reports.

Erdogan was known for his controversial view of the causal relationship between interest rates inflation, insisting that inflation is caused by high interest rates. He had also frequently quoted Quran’s edict against usury to defend an ultra-low interest rate policy, which brought Turkey to the brink of currency crises. The last such near-miss happened in the waning days of 2021, where a BoP crisis was averted by the introduction of FX protected deposit scheme, which essentially guaranteed the dollar value of TL deposits. The balance of this form of saving reached almost $100 bn at some point, posing a huge threat to financial stability.

Since the appointment of economy czar Mehmet Simsek and the Central Bank governor Fatih Karahan, Erdogan steered away from commenting on interest rates.

“We will definitely start lowering interest rates. 2025 will be the mark year for this,” he said during a speech on Saturday in the province of Bursa. “Interest rates will come down so that inflation will also come down. This is a must for us,” he added.

He said in addition to monetary policy, other tools will also be used to bring down inflation.

Erdogan’s speech comes after the Central Bank cut the policy rate for the first time since 2023 at its December meeting. The bank lowered its one-week repo rate to 47.5% from 50%, exceeding market expectations while emphasizing it will make future rate decisions prudently based on the inflation outlook and will not necessarily continue easing rates at the same pace.

After the rise in prices continued to weigh on the economy in 2023, mostly due to the ultra-loose monetary policy championed by Erdogan, the president appointed an economy team that launched an orthodox monetary policy following elections that year. Since then, the Central Bank hiked rates from single digits to as high as 50% in less than a year.

The bank also reduced the number of meetings it will hold next year to eight from 12. Analysts are now expecting the Turkish central bank to deliver sizable interest-rate cuts at every policy meeting in 2025, despite officials cautioning against an uninterrupted easing cycle.

In his speech on Saturday, Erdogan said so-called “opportunists” should bear some of the blame for persistent inflation. “There are some who are exploiting the free market economy. We will overcome them too. The most effective method is for our nation to boycott those who raise prices exorbitantly,” he said.

Erdogan also promised to review the 30% hike to the minimum wage, promising to compensate workers if inflation turns out to be higher than predicted.

Erdogan’s statement could be simply an effort to take credit for CBRT’s upcoming interest rate cuts, which are expected to last throughout 2025. However, if he repeats his controversial view, CBRT will lose credibility and global fund managers may prefer to stay away from Turkey, recalling past disasters when Erdogan made monetary policy.

IMPORTANT DİSCLOSURE: PA Turkey intends to inform Turkey watchers with diverse views and opinions. Articles in our website may not necessarily represent the view of our editorial board or count as endorsement.

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/