Fitch: Turkish Corporates Take Steps to Address FX Mismatches

Fitch

Fitch

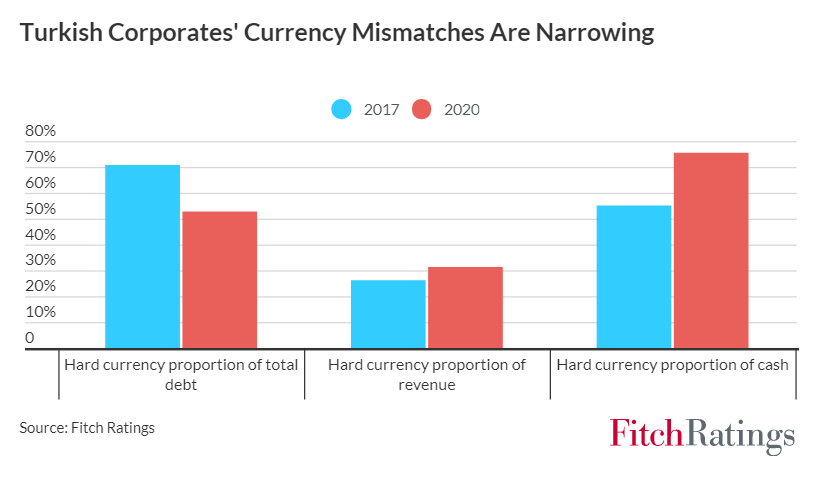

Turkish companies have reduced the proportion of their debt denominated in foreign currencies and are holding more foreign-currency cash, Fitch Ratings says. However, the use of hard-currency borrowing is still widespread and not always effectively hedged or balanced by foreign-currency-denominated revenues.

Emerging market corporates face the risk of potential strengthening of the US dollar. Turkish corporates have historically been among the most exposed to these risks. Among the companies we examined for our new report, hard currencies account for an average 70% of debt but only 46% of revenue.

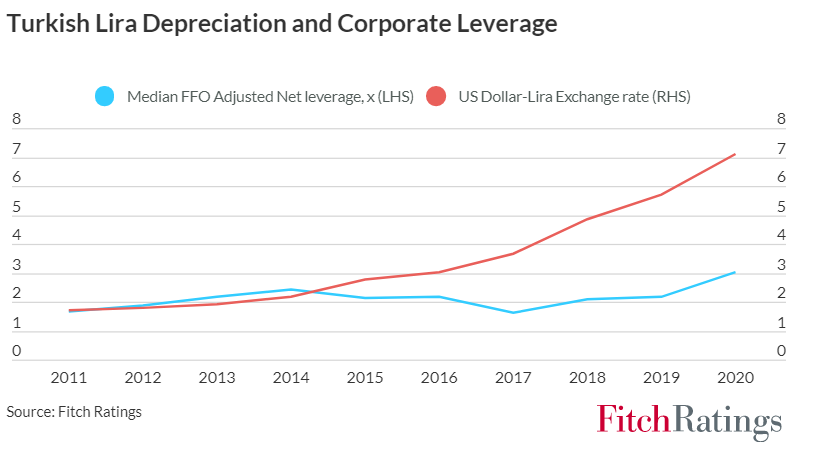

Turkish corporates’ exposure to FX risks has been highlighted by severe Turkish lira depreciation over the past decade, including during the 2013 “taper tantrum” and further bouts of volatility since 2018. We expect the US Federal Reserve to begin tapering its asset-purchase programme around the end of the year.

If the lira deteriorates, companies with a mismatch may need to service inflated foreign-currency-denominated debt with local-currency revenues. Risks can be exacerbated when this debt is short-term, as companies are more likely to find themselves having to physically repay debt with foreign currency, using cash or accommodative financing.

While FX risk remains a key factor in Turkish corporates’ ratings, comparing current exposure to data from end-2017 indicates that companies have taken steps to manage these risks. For the subset of issuers where the historical split of hard versus local currencies is available, aggregate hard-currency debt has declined to 53% of total unadjusted debt from 71% while the proportion of hard-currency revenues has edged up to 31% from 26%.

At the same time, issuers have increased their cash holdings, which should strengthen liquidity in the event of market disruption. Overall cash holdings in this cohort have increased to 28% of aggregate revenue, from 21% at the end of 2017. The proportion of this cash held in hard currencies has also risen to 76% from 55% in 2017.

A mitigating factor for companies with a mismatch is their ability to pass on higher costs to their customers through higher sales prices. Flexible dividend policies could also help alleviate pressure on credit metrics when the lira depreciates. Turkish corporates’ ability to mitigate the FX impact means that, despite average annual depreciation of around 14% over the past decade, leverage has not shown the same one-way trend. It has, however, been relatively volatile, highlighting the potential for short-term risks at times of rapid depreciation.

A mitigating factor for companies with a mismatch is their ability to pass on higher costs to their customers through higher sales prices. Flexible dividend policies could also help alleviate pressure on credit metrics when the lira depreciates. Turkish corporates’ ability to mitigate the FX impact means that, despite average annual depreciation of around 14% over the past decade, leverage has not shown the same one-way trend. It has, however, been relatively volatile, highlighting the potential for short-term risks at times of rapid depreciation.

Turkish corporates are often more dependent on short-term funding than international peers and frequently only have access to uncommitted bank lines, rather than a committed revolving credit facility. This can make them more exposed to the risk of temporary funding interruptions and market closures.

We have not seen any significant change in the past few years in companies’ reliance on uncommitted lines. Nor has there been much change in the distribution of debt maturities over the period, with issuers regularly facing the need to refinance debt maturing within a 12-month period. However, the increase in cash balances, especially in hard currencies, may mitigate these risks.

Fitch Ratings

Turkish corporates are often more dependent on short-term funding than international peers and frequently only have access to uncommitted bank lines, rather than a committed revolving credit facility. This can make them more exposed to the risk of temporary funding interruptions and market closures.

We have not seen any significant change in the past few years in companies’ reliance on uncommitted lines. Nor has there been much change in the distribution of debt maturities over the period, with issuers regularly facing the need to refinance debt maturing within a 12-month period. However, the increase in cash balances, especially in hard currencies, may mitigate these risks.

Fitch Ratings

A mitigating factor for companies with a mismatch is their ability to pass on higher costs to their customers through higher sales prices. Flexible dividend policies could also help alleviate pressure on credit metrics when the lira depreciates. Turkish corporates’ ability to mitigate the FX impact means that, despite average annual depreciation of around 14% over the past decade, leverage has not shown the same one-way trend. It has, however, been relatively volatile, highlighting the potential for short-term risks at times of rapid depreciation.

A mitigating factor for companies with a mismatch is their ability to pass on higher costs to their customers through higher sales prices. Flexible dividend policies could also help alleviate pressure on credit metrics when the lira depreciates. Turkish corporates’ ability to mitigate the FX impact means that, despite average annual depreciation of around 14% over the past decade, leverage has not shown the same one-way trend. It has, however, been relatively volatile, highlighting the potential for short-term risks at times of rapid depreciation.

Turkish corporates are often more dependent on short-term funding than international peers and frequently only have access to uncommitted bank lines, rather than a committed revolving credit facility. This can make them more exposed to the risk of temporary funding interruptions and market closures.

We have not seen any significant change in the past few years in companies’ reliance on uncommitted lines. Nor has there been much change in the distribution of debt maturities over the period, with issuers regularly facing the need to refinance debt maturing within a 12-month period. However, the increase in cash balances, especially in hard currencies, may mitigate these risks.

Fitch Ratings

Turkish corporates are often more dependent on short-term funding than international peers and frequently only have access to uncommitted bank lines, rather than a committed revolving credit facility. This can make them more exposed to the risk of temporary funding interruptions and market closures.

We have not seen any significant change in the past few years in companies’ reliance on uncommitted lines. Nor has there been much change in the distribution of debt maturities over the period, with issuers regularly facing the need to refinance debt maturing within a 12-month period. However, the increase in cash balances, especially in hard currencies, may mitigate these risks.

Fitch Ratings