Fitch’s Eid gift: Agency downgrades Turkey’s debt rating to ‘B’ from ‘B+’

fitch

fitch

Ratings agency Fitch on Friday downgraded Turkey's debt rating to 'B' from 'B+', citing increasing inflation, reported Reuters.

Inflation in Turkey shot to a 24-year high, standing at 78.62% in June, mainly due to a currency crisis at the end of last year and the lira's continued decline read more .

The agency affirmed its outlook at 'negative', adding that it expects Turkey's consumption to slow given rising inflation, a weaker exchange rate and diminishing domestic confidence.

Erdogan’s Lethal Economic Legacy

The economic fallout from Russia's invasion of Ukraine has also stoked prices in import-dependent Turkey, especially due to rising energy and commodity costs.

The rating note from the credit agency states:

KEY RATING DRIVERS

The downgrade of Turkiye's IDRs and the Negative Outlook reflects the following key rating drivers and their relative weights:

High

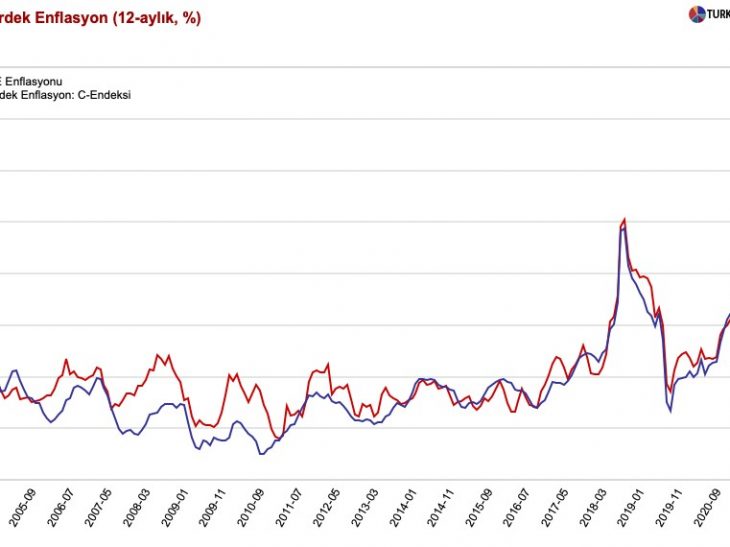

Spiralling Inflation: We forecast annual inflation to average 71.4% in 2022, the highest of Fitch-rated sovereigns and its trajectory remains highly uncertain due to increased risks of backward indexation, rising expectations and additional lira depreciation, as the exchange rate pass-through has increased in both speed and magnitude. Inflation will average 57% in 2023, as we expect the overall policy mix to remain overly accommodative at least until the 2023 elections.

Policies Increase Macro and External Risks: Guided by political considerations, the central bank has maintained its policy rate at 14% since December 2021, despite rapidly rising inflation, the impact of the war in Ukraine on commodity markets and tightening monetary policy in most advanced economies. The government's focus on maintaining high growth feeds FX demand, depreciation pressures on the lira, decline in international reserves and spiralling inflation, and discourages capital inflows to fund the higher current account deficit.

Increasingly Interventionist Policies: Fitch considers that selective macroprudential policies to reduce the pace of rapid credit growth and tighter capital flow management measures do not reduce risks to macroeconomic and financial stability. Moreover, as exemplified by recent regulations conditioning corporates' access to local currency credit depending on the level of their FX assets, policies are becoming increasingly interventionist as well as unpredictable. There is a risk that in the event of weaker depositor confidence or a deterioration in the until-now resilient access of banks and corporates to external financing, official international reserves would come under pressure, as a significant portion of banks' foreign currency assets is held in the central bank.

Higher Financing Needs, Limited Inflows: Higher energy prices and weaker external demand will result in a current account deficit of 5.1% of GDP in 2022 despite a recovery in tourism. Although net errors and omissions have supported the balance of payments in recent years, the limited visibility of their nature and resilience maintains the risk of additional pressure on international reserves ahead. External debt maturing over the next 12 months (end-April) amounts to USD182 billion. Access to external financing for the sovereign and private sector has a record of resilience, but remains vulnerable to changes in investor sentiment, especially given tighter global financing conditions and Turkiye's increased funding costs. Turkiye's issuance of total USD5 billion in early 2022 and foreign-currency (FC) cash buffers reduce near-term financing risks for the sovereign.

International Reserves Under Pressure: International reserves have declined to USD101 billion (net reserves at USD7.5 billion) despite FX deposit conversion and capital flow management measurements, including surrender requirements for exporters. We estimate that the central bank net FX asset position turned slightly negative in June and fell to minus USD64 billion when excluding FX swaps, similar to December 2021 levels. We forecast international reserves to decline to USD94 billion by end-2022 and to USD88 billion in 2023, bringing reserve coverage of current external payments to 2.7 months, below the forecast 'B' median of 3.8 months.

High Financial Dollarization: Currently, FC-denominated (56%) and -linked deposits account for 71% of total deposits. In addition to high dollarisation, banks are vulnerable to FX volatility due to high external debt payments and the impact on asset quality (38% of loans are FC-denominated). FX protected deposits (USD62 billion in early July) not only create fiscal costs and FX linked contingent liabilities for the sovereign, but also could add to domestic FX demand in the event of reduced renewals.

Turkiye's 'B' IDRs also reflect the following key rating drivers:

High Revenue Growth Contains Deficits: Supported by strong revenue growth, Fitch estimates that Turkiye's central government deficit will reach 3.3% of GDP, outperforming the 3.5% 2022 budget target. Fiscal risks are related to the impact of weaker economic activity on revenues, expenditure pressures related to adjustment of salaries and pensions due to high inflation, rising interest bill and transfer to SOEs, most notably those in the energy sector.

Turkiye is increasingly reliant on the budget to reduce FX demand and mitigate the impact of high inflation on the economy. Based on official estimates, measures to ease the impact of inflation could equal TRY241 billion (1.8% of 2022 forecast GDP). The final cost is likely to be larger, as compensation for FX deposits alone could reach 3.1% of GDP with the budget responsible for 1.4% of GDP using our end-year exchange rate forecast of 20 lira per USD. Moreover, the government's willingness to introduce new instruments to reduce FX demand, such as revenue-linked securities, could increase costs to the budget.

Declining Government Debt: After increasing to 42% of GDP in 2021, Fitch forecasts general government debt to decline to 36% in 2022, significantly below the forecast 62% for the 'B' median, reflecting a high deflator, negative real rates for domestic debt and continued real growth. Government remains vulnerable to currency risk, as 67% of central government debt was FC-linked or denominated at end-May, up from 39% in 2017.

Slower Growth: Despite adjustments to minimum wage, public sector and pensions, we expect consumption to slow given rising inflation, a weaker exchange rate and weakening domestic confidence. Weak EU growth will weigh on external demand. We forecast growth to reach 4.5% in 2022, but to slow to 3.0% in 2023 and 2.9% in 2024, in the context of high inflation, tighter financing conditions and slower global growth.

Elections Approaching, Challenging Diplomatic Balance: President Erdogan has declared his candidacy for the next general elections due by June 2023. We expect the proximity of general elections to heavily influence policy in the direction of supporting growth. The six-party opposition alliance has yet to select a candidate. The war in Ukraine has required Turkiye to manage a complex diplomatic balance. Turkiye has maintained its support for the territorial integrity of Ukraine and recently approved the NATO candidacy of Sweden and Finland after initially raising objections to the new entrants. Nevertheless, Turkiye has not joined sanctions against Russia and maintains commercial and diplomatic relations.

ESG - Governance: Turkiye has an ESG Relevance Score (RS) of '5' for both Political Stability and Rights and for the Rule of Law, Institutional and Regulatory Quality and Control of Corruption. Theses scores reflect the high weight that the World Bank Governance Indicators (WBGI) have in our proprietary Sovereign Rating Model. Turkiye has a medium WBGI ranking at 37 reflecting a recent track record of peaceful political transitions, a moderate level of rights for participation in the political process, moderate but deteriorating institutional capacity due to increased centralisation of power in the office of the president and weakened checks and balances, uneven application of the rule of law and a moderate level of corruption.

RATING SENSITIVITIES

Factors that could, individually or collectively, lead to negative rating action/downgrade:

-Macro: Continuation of a policy mix that fails to reduce macroeconomic and financial stability risks, for example an inflation-exchange rate depreciation spiral or weaker depositor confidence.

-External Finances: Increased balance of payments pressures, including sustained reduction in international reserves, for example due to reduced access to external financing for the sovereign or the private sector and/or sustained widening of the current account deficit.

-Structural features: A serious deterioration in the domestic political or security situation or international relations that severely affects the economy and external finances.

Factors that could, individually or collectively, lead to positive rating action/upgrade:

- Macro: A credible and consistent policy mix that stabilises confidence, improves predictability and reduces macroeconomic and financial stability risks, for example by sustainably reducing inflation.

-External Finances: A reduction in external vulnerabilities, for example due to sustained narrowing of the current account deficit, increased capital inflows, improvements in the level and composition of international reserves and reduced dollarisation.

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/