The Turkish economy's relentless battle between growth and inflation continues. Let us first go through the concrete data announced. Then, in the second part of this article, we will try to explain where this data fits into the overall macroeconomic framework with regards to disinflation efforts.

Growth continued to strengthen

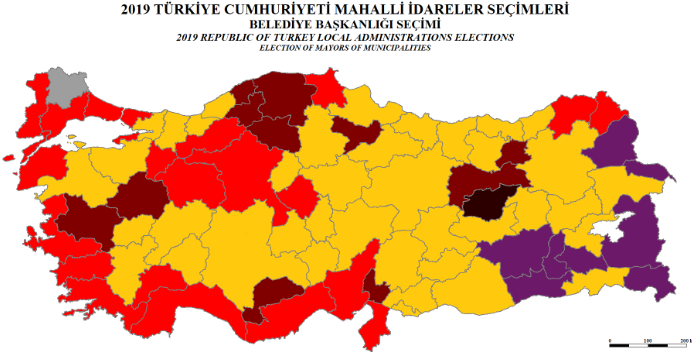

Turkish economy grew by 4.0% yoy in the last quarter of 2023, above the median expectation of 3.6%. Thus, the growth rate for 2023 was realized as 4.5%.

Seasonally and calendar adjusted GDP increased by 1.0% qoq. The quarter-on-quarter change from the election period 2023, which rose to 3.6% in the second quarter, slowed to 0.3% in the third quarter.

In short, growth regained strength in the last quarter of 2023.

The dollar equivalent of the total national income for the last four quarters was 1 trillion 119 billion dollars, a new historic high. Thus, GDP per capita rose to $13,110, 24.9% above the $10,655 in 2022.

TurkStat announced that in 2023 it will use the "import exchange rate obtained from Foreign Trade Statistics" instead of the "daily CBRT exchange rate weighted by imports" used to calculate annual GDP in dollars in the post-2018 series.

Private consumption is the source of growth, industry is losing strength

As of the last quarter of 2023, it is difficult to find a significant change in the growth picture of the Turkish economy, which is based on excessive domestic consumption that creates inflation.

On the production side, construction, services and finance sectors stood out in the last quarter. The quarter-on-quarter contraction in industry is remarkable.

The year-on-year change in total value added for the main sectors is as follows: Agriculture +0.5%, Industry +1.9%, Manufacturing +1.7%, Construction +10.8%, Services +3.0%, Finance +7.4% and Real Estate Activities +2.8%.

Quarter-on-quarter sectoral growth rates better reflect the underlying trend of growth.

In this respect, Agriculture is weak with +0.1%. Industrial sector contracted by 0.8% quarter-on-quarter, indicating that its production leg lost strength. Construction, which contracted by 0.8% in the third quarter, jumped by 6.5% in the last quarter. Services also grew by 1.1% in the last quarter after contracting by 1.1% in the third quarter. Finance 2023, after jumping by 4.4% in the first quarter, lost momentum during the year, but strengthened its growth in the last quarter, reaching 1.1%.

In the expenditure-method growth calculation, we observe that private consumption rebounded in the last quarter of 2023 after a sharp slowdown in the third quarter. Final consumption of households contributed +6.7 points to growth in the last quarter. Investment expenditures also continue to be strong, contributing 2.6 points to growth. Net external demand made a negative 0.6 pp contribution to growth as import growth outpaced export growth. Unsurprisingly, the decline in inventories also weighs on growth by 5.0 percentage points.

Given the high and rising inflation expectations, household consumption demand has shifted back to durable goods. Meanwhile, mandatory expenditures such as non-durable goods have weakened significantly compared to the first half of 2023.

Annual changes in expenditures by main groups in the last quarter were as follows: final consumption of households +9.3%, final consumption expenditures of government +1.7%, gross fixed capital of private and public aggregate +10.7%, exports of goods and services +0.2% and imports of goods and services +2.7%.

Earthquake strengthened construction investments as machinery investments continue strong within the GDP accounts. TurkStat does not disclose the details of the private and public sectors in total gross fixed capital formation. However, in the tables it does provide, it is possible to find a breakdown of investments into machinery and construction.

What is observed here is that machinery-equipment investments continued to grow with an annual increase of 14.0%, capturing 17 quarters of growth since the last quarter of 2019.

After the February 6 earthquakes, construction investments strengthened in the last two quarters of the year with annual growth of 8.0% and 7.5%, respectively.

Wage earners' share of growth falls again

As a final word, it is important to note that while the Turkish economy grew by 4% in the last quarter, the division between labor and capital worsened again to the detriment of labor. According to statements from the government, the inflation adjustment of wages will be made once in 2024 at the beginning of the year. In other words, real wages will be eroded against CPI inflation, which is expected to be around 65% in mid-2024. In this case, beyond the first quarter of 2024, we will see the wage sector's share of value added continue to deteriorate every consecutive quarter.

Where is growth heading and where is inflation heading?

For the central bank, which raised interest rates rapidly from 8.5% to 42.5% in June-December 2023, the resurgence of growth in the last quarter of 2023 on domestic demand is not a good development in terms of moving towards the 36% inflation target for end-2024.

In shorter words, "rebalancing" is not enough. The 6.7% CPI inflation rate in January is proof of this.

One of the main reasons for this is the calculation that inflation will rise from 64% at the end of 2023 to over 70% per annum by May 2024. This is an expectation also accepted by the CBRT. We see from the last quarter's growth data that the cycle in which the consumer "pulls today's demand for durable consumer goods", which he thinks will be "more expensive tomorrow", continues.

Therefore, the growth rate is not expected to weaken significantly in the first quarter of 2024 in a way to restrain inflation. PMI and consumer confidence indices have strengthened in terms of January-February data. Confidence indices in retail and service sectors are on the rise, indicating that consumption is buoyant, while the construction sector looks like it will remain on the growth path for longer quarters with activities after the earthquake.

Capacity utilization rate and real sector confidence index are weaker than the previous quarter, indicating that the contraction in industrial production will continue.

As of the first quarter of 2024, the general expectation is that the election economy will be in effect on the fiscal side. After the local elections, the current tightening in monetary policy will be accompanied by fiscal policy. Having suspended interest rate hikes until the local elections, it is a difficult step for the CBRT to raise interest rates, which continues to keep the current policy rate behind inflation. Despite all its steps, the CBRT is still "chasing the runner" and is not perceived as having a stance free from political influences.

After the March 31 local elections, a period of tightening in public finance is expected instead of monetary policy. However, it is widely believed that the expected fiscal tightening will come through additional taxes. There is no significant spending cut plan reflected in the press.

External demand will start to contribute to growth in the Turkish economy, especially by the last quarter of 2024. The contribution of net foreign trade to growth will turn positive again by the end of 2024.

Contrary to the output gap expectation highlighted in the CBRT's Inflation Report, end-2024 GDP is likely to be close to the MTP target of 4%, remaining in the 3.5-4% range. At least as of early March 2024. We can start expecting a decline in inflation beyond the base effect only if growth stays at 3.5% or below the potential level.

On the current trajectory, a CPI inflation of around 50% seems much more realistic for end-2024 than 36%.

The end-2025 target of 14% and the single-digit inflation target for 2026 are not even worth discussing at this stage.

inflation_batman

inflation_batman