- Turkey has substantially outgrown the rest of EM in the COVID-19 shock.

- It has also seen a more rapid and marked decline in its official FX reserves.

- This Global Macro Views makes the case that the two phenomena are linked.

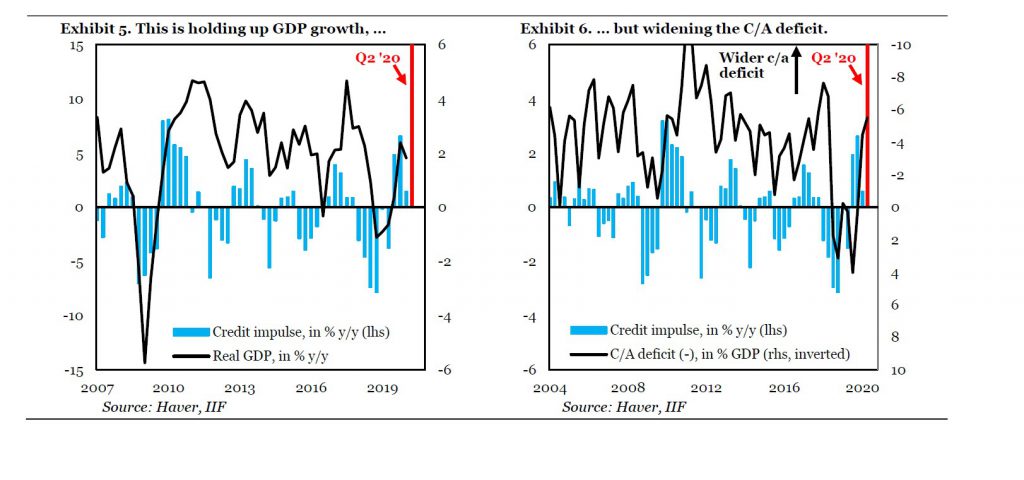

- A large credit expansion is supporting growth in the face of the COVID-19 shock.

- But that credit expansion is also contributing to a wider current account deficit, …by supporting imports even as exports are collapsing due to weak global demand.

- This is putting downward pressure on official FX reserves and the Turkish Lira.

Turkey outgrew all other emerging markets in Q1 2020, the peak of COVID-19 uncertainty. GDP grew 4.4 percent in year-over-year terms, faster than traditional high-growth economies like Vietnam (4.0 percent), India (3.0 percent) and Indonesia (2.9 percent). However, controlling for the stock of official FX reserves, Turkey also saw the fastest pace of reserve depletion across all EM, something that is at first glance hard to reconcile with the upbeat growth picture. This Global Macro Views argues the two things are related.

The largest ever credit expansion, bigger than 2017, is supporting economic activity in the face of COVID-19. But that credit expansion is also one reason the current account deficit has widened to levels last seen ahead of the BoP sudden stop in August 2018, putting downward pressure on official reserves and the Lira. Unfortunately, this means policy makers face an unappealing trade-off. They can push for high growth via credit expansion, but that will likely entail further declines in reserves and the Lira. Or they can decide to put the emphasis on shoring up reserves and Lira stability, which will come at the expense of growth. Ultimately, it is impossible for Turkey to maintain strong credit-led growth and a stable Lira.

Our systematic tracking of growth across EM shows Turkey to be the best performer in Q1, the epicenter of the COVID-19 shock with growth of 4.4 percent in year-over-year terms the top of the range. At the same time, controlling for the stock of official foreign exchange reserves before COVID-19, the pace of reserve depletion is far beyond anything any other EM experienced in March and April. These two data points seem contradictory, but have a common underlying driver. Turkey is seeing a very large credit expansion, with weekly flows far surpassing the 2017 credit boom, putting our centered 13-week moving average measure at truly unprecedented levels .

There is no doubt that this credit expansion supports growth in the face of the COVID-19 shock and is therefore partly desirable. But it also carries the risk of destabilizing the balance of payments and the Lira.

We have long looked at Turkey’s GDP growth through the lens of the credit impulse, the change in the flow of credit, which is what drives economic activity. That credit impulse measures 6.1 percent in year-over-year terms in the current quarter, four times as large as the credit impulse in mid-2017, and no doubt an important source of support for the economy in Q2 and Q3.

However, there are also signs that this credit expansion has begun to widen the current account deficit. We estimate that the current account deficit is already running in excess of -5.0 percent of GDP in Q2, as imports – supported by the credit expansion – fail to contract sufficiently to offset export weakness. Ultimately, all this points to an unfortunate trade-off between growth and Lira stability. Growth will either need to slow to ensure a more stable currency. Or the Lira will continue falling to make room for growth.

You can follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/