The International Monetary Fund forecast strong growth for Turkey this year, while saying risks have increased after reserves declined from previously low levels.

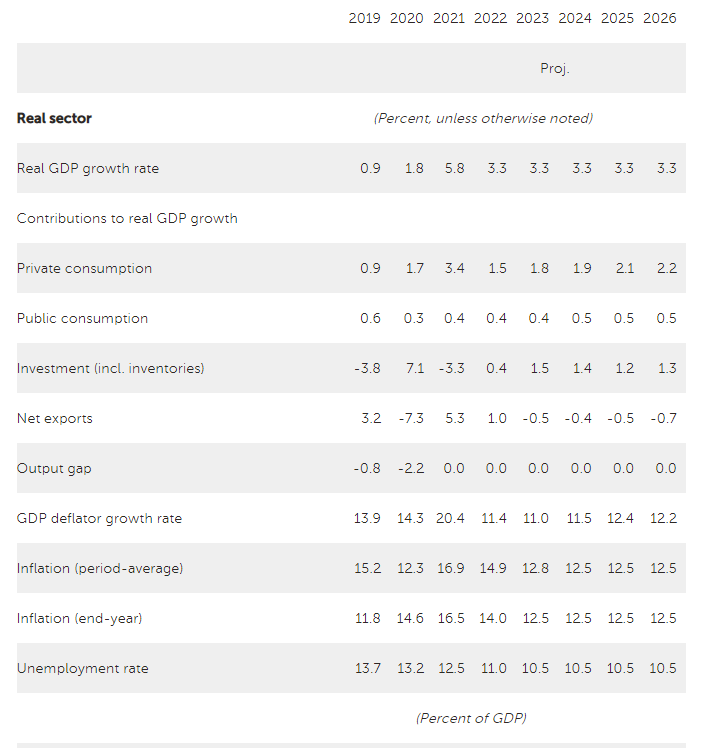

Gross domestic product in Turkey is expected to expand by about 5.75% in 2021 and return to a slower trend next year (%3.3), the IMF said in statement on Friday after a so-called Article IV review mission to the country.

Turkey’s gross reserves are well below the recommended adequacy range, and net international reserves are negative when foreign-exchange swaps with the central bank are excluded, according to the IMF.

Turkey’s fiscal space is limited by contingent liabilities and potential debt rollover pressures, while lira depreciation added to non-financial corporate and bank balance sheet strains, according to the IMF.

Turkish Central Banker Opens Up on Using Reserves to Buoy Lira

Turkish Inflation Slows Unexpectedly, Raising Rate Cut Pressure

IMF executive directors called for further reining in and refocusing of credit growth at state-owned banks and monitoring of bank foreign-exchange liabilities, according to the statement. They also called for structural reforms to counter the impact of the Covid-19 pandemic, increased labor-market flexibility and restructuring of viable, temporarily insolvent firm and the winding down of unviable firms.

Bloomberg