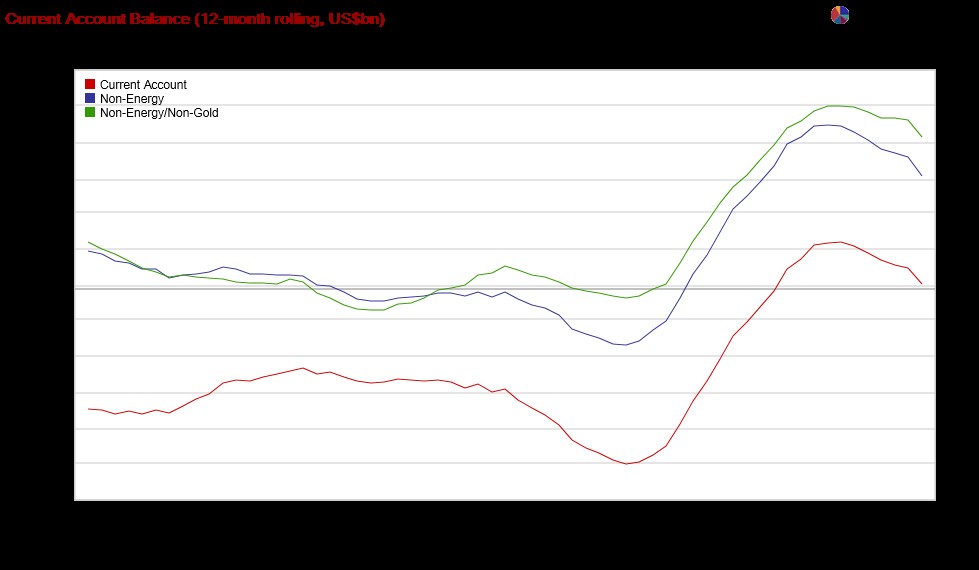

Monthly current account balance generates deficit… According to the balance of payments data published by the CBRT, the current account balance gave a deficit of US$4.9bn in March 2020. The current account deficit was US$120mn in the same month of the previous year. Thus, while the 12-month rolling current surplus fell from US$6.3bn to US$1.5bn, the current account surplus fell from 0.8% to 0.1% with respect to our estimated GDP. The non-energy balance also gave a deficit of US$2.6bn in March, while the 12-month non-energy current account surplus fell from US$39.6bn to US$34.0bn; except for energy and gold, the surplus came down from US$50.6bn to US$45.6bn.

The fall in tourism and exports disrupts the current account balance… In this deterioration in the current account balance, both 18.0% contraction in exports against 3.4% increase in imports and the 50.7% decrease in tourism revenues have been effective. In March, the 12-month total tourism revenue fell from US$26.1bn to US$25.6bn. In April, although imports seem to have declined compared to the previous year, we can witness that the decline in exports is much higher than imports and the decrease in tourism revenues has deepened. Thus, in the next two months, we can see that the 12-month total current surplus turned negative. The factor that may reverse this situation may be that imports have decreased at a much higher rate due to the decrease in oil prices, domestic demand contraction and the pandemic making logistics in some sectors very limited.

Visible capital outflow… In March, pandemic’s effects on capital movements became visible. The capital outflow was US$7.7bn on monthly basis, which was US$1.6bn in the same month of last year. Thus, the 12-month rolling capital account balance generated US$4.9bn deficit, compared to US$1.2bn surplus recorded a month ago. While there was a US$5.5bn outflow from portfolio investments on a monthly basis, US$1.1bn of this output was realized from the stock market and US$2.1bn were due to foreign investor outflows from the bond market. Other investments, on the other hand, experienced a capital outflow of US$3.0bn, mainly due to the US$2.6bn decrease in foreign deposits. Debt reduction trend continued in non-bank sectors, and the debt rollover ratio declined from 90% to 84.1% on a 12-month total basis. In banks, this rate increased slightly from 73.3% to 74.2%. In addition to the US$4.9bn current account deficit and the US$7.7bn capital outflow, US$4bn deficit recorded as net errors and omissions have led to a reserve use of US$16.6bn. Thus, reserves decreased by US$13.3bn on a 12-month rolling basis.