CPI inflation was 1.64% in june, leading to a fall in YoY terms to 71.60% from 75.45%. TurkStat revealed June CPI inflation as 1.64% MoM, considerably below the 2.2% median market expectation (Foreks survey), although it was closer to our 1.75% estimate. Core CPI (group C) inflation at 1.73% MoM (June 2023: 3.84%) painted a brighter picture as this was below our 2.6% estimate. As a result, core inflation fell to 71.4% from 75.0% in YoY terms. Finally, the favourable impact of the currency stability was more pronounced in D-PPI inflation with a 1.38 MoM outcome (June 2023: 6.5%), leading to a sizeable decline in YoY terms to 50.1% from 57.7%.

The stable course of the currency helped core inflation in June, but rigidity in service inflation persisted. Although June CPI inflation fell below market expectations, it was close to our forecast of 1.75%. Examining the details of inflation, we see that food inflation, which we expected to be slightly above 1.0%, came in at 1.7%.

As such, this indicates a more favorable picture on the core inflation front than we had anticipated. This improvement is primarily due to a 0.5% MoM decline in durable goods prices, driven by currency stability, alongside a seasonal 0.68% decrease in clothing prices. Conversely, service inflation, a key contributor to inflation inertia, remained at 3.3%, indicating ongoing rigidity.

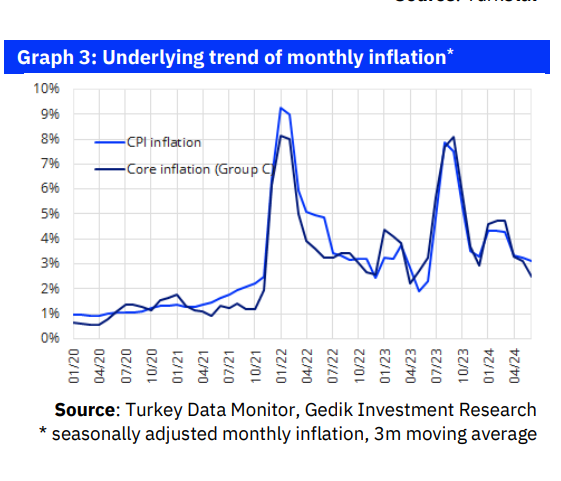

The underlying monthly inflation remains inconsistent with the CBRT’s longterm inflation forecasts.

Analyzing the CBRT’s closely monitored metrics, such as the three-month moving average of seasonally adjusted monthly inflation, we observe a modest decline in headline CPI inflation to 3.1% from 3.3%, and in services inflation to 3.5% from 3.6%. These figures remain above the CBRT’s forecast trajectory, as the CBRT earlier expressed that the monthly inflation trend should decline to around 1.5% in 4Q24 to meet its end-2024 and end2025 CPI inflation forecasts (38% and 14%).

The recent 38% hike in electricity prices, coupled with anticipated SCT-driven increases in cigarette, alcohol, and fuel prices, is likely to push July CPI inflation above 3.0%. The indirect effects of these price hikes will gradually reflect on monthly inflation figures. Yet, with strong base effects coming into play, we expect CPI inflation to decrease to slightly above 60% in July and slightly above 50% in August.

Despite this decline, we believe that the current state of domestic demand and the inflation trend are not yet sufficient for the CBRT to commence a rate-cutting cycle soon.

By Serkan Gonencler, Chief Economist, Gedik Invest

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/