The August results of the Turkey Household Inflation Expectations Survey (TEBA) conducted by Koç University and Konda Research and Consulting company were announced.

Accordingly;

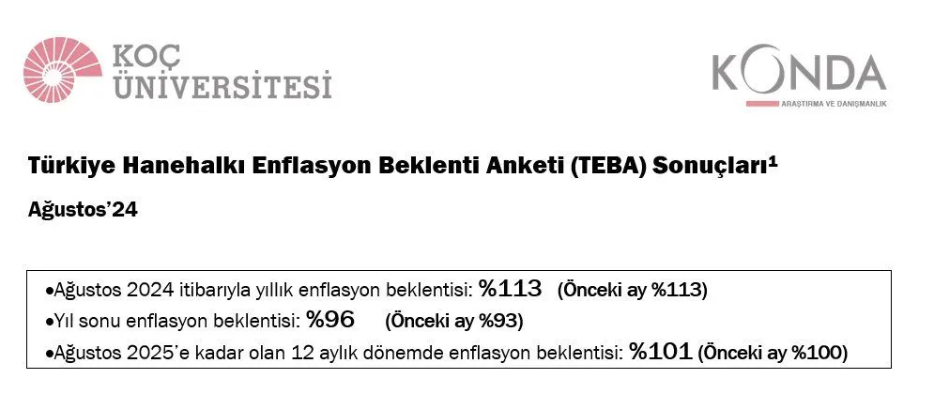

-The annual inflation expectation of the households as of August 2024 was determined as 113 percent. This rate was 113 percent in July results.

-The year-end inflation expectation of households increased by 3 points compared to the previous month and became 96 percent. In July, this rate was 93 percent.

-The 12-month inflation expectation of households for August 2025 increased by 1 point to 101 percent. In July, this rate was 100 percent. Koç University Economics Department Faculty Member and former US Federal Reserve Economist Prof. Dr. Selva Demiralp evaluated the results of the August Household Inflation Expectations Survey on her X (Twitter) account.

Prof. Dr. Demiralp said, “The change in 12-month-ahead expectations is consistent with the CBRT’s sectoral inflation expectations survey published in August.

In the CBRT survey, a similar increase in household expectations was observed in the last two months. However, the level of expectations in the TEBA survey remains higher.”

Explaining why this is not reflected in inflation expectations despite the 10-point decline in headline inflation compared to the previous month, Selva Demiralp said, “The responses suggest that the monthly inflation trend and perceived inflation are more dominant than the base effect.”

What do the results according to age status show?

Prof. Dr. Demiralp shared the results of the analysis according to the age status of the interviewees and continued as follows:

* In parallel with the increasing age groups, it is observed that 12-month ahead inflation expectations have also increased. Individuals over the age of 50, who have the highest inflation expectations, may be expected to have a higher weight of services sector items such as education and health in their consumption basket. The headline figure of 104% yoy recorded in education services in July may be an influential factor in the higher inflation expectations of the over-50 age group, who are more likely to have children of school-age.

What do the results show according to employment status?

Prof. Dr. Demiralp shared the results according to the employment status of the interviewees and continued as follows:

* It is observed that the retired group with the highest 12-month forward inflation expectation has an expectation approximately 15 points above the general average, while the student group with the lowest inflation expectation has an expectation approximately 13 points below the general average. It is noteworthy that the retired group is the group that expresses the most difficulty in terms of subsistence.

What do the results show according to income status?

According to a grouping based on total income declarations:

* While inflation expectations in the lowest income bracket deteriorated significantly compared to the previous month, a convergence is observed in the expectations of upper income groups.

The Central Bank had recently shared the Sectoral Inflation Expectations survey with the public. In the survey, the year-end inflation expectation of households was determined as 73.1 percent. The year-end inflation expectation of market participants was 28.7 percent, while that of the real sector was 53.8 percent. It is noteworthy that there is a significant gap between the inflation expectations of market participants and households in the survey results.