September CPI inflation rate came in at 2.97% MoM, while the annual CPI inflation rate decreased to 49.4% from 52.0%.

TurkStat revealed September’s CPI inflation as 2.97%, significantly higher than our estimate and the median market expectation of 2.2%. That said, the YoY CPI inflation rate fell to 49.38% from 51.97%, due to strong base effects (September 2023: 4.75%). Core CPI inflation (Group C) registered at 3.6% MoM, also significantly exceeding the median expectation and our estimate at 2.4% and 2.5%, respectively.

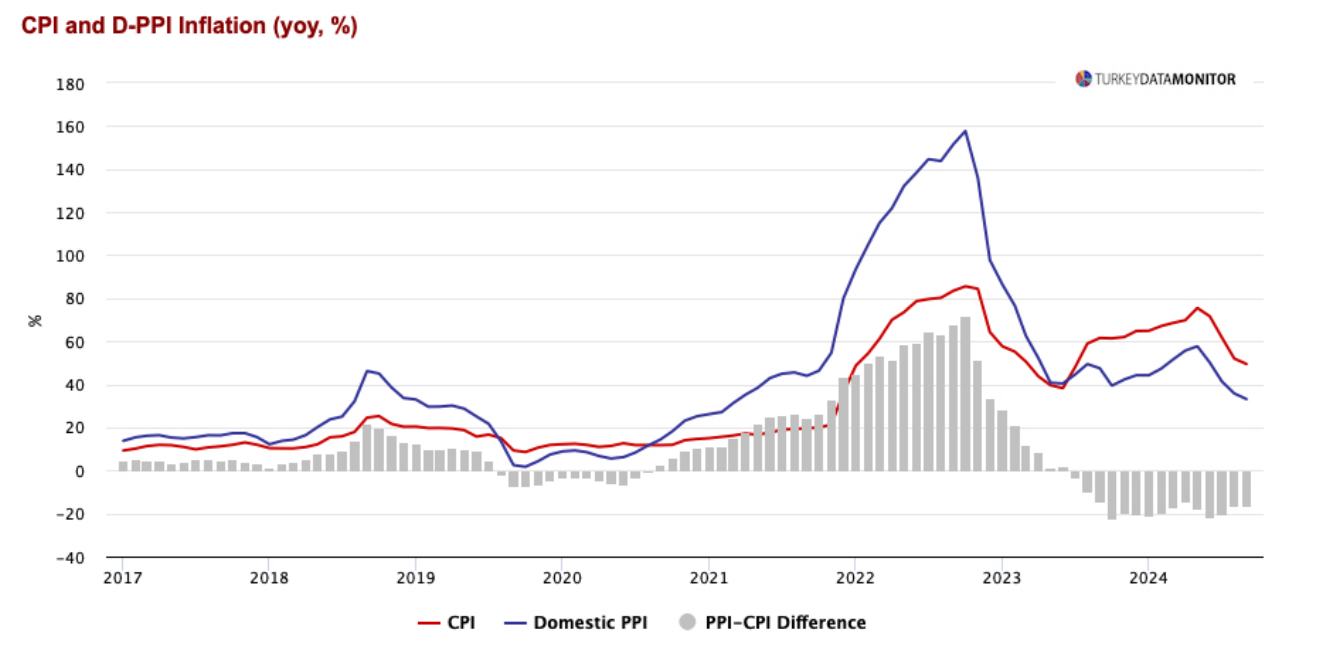

Thanks to base effects, YoY core inflation also eased to 49.1% from 51.6%. Domestic PPI inflation maintained its moderate trajectory, also supported by declining oil prices, registering a MoM outcome of 1.37%, and decelerating in YoY terms to 33.1% from 35.8%.

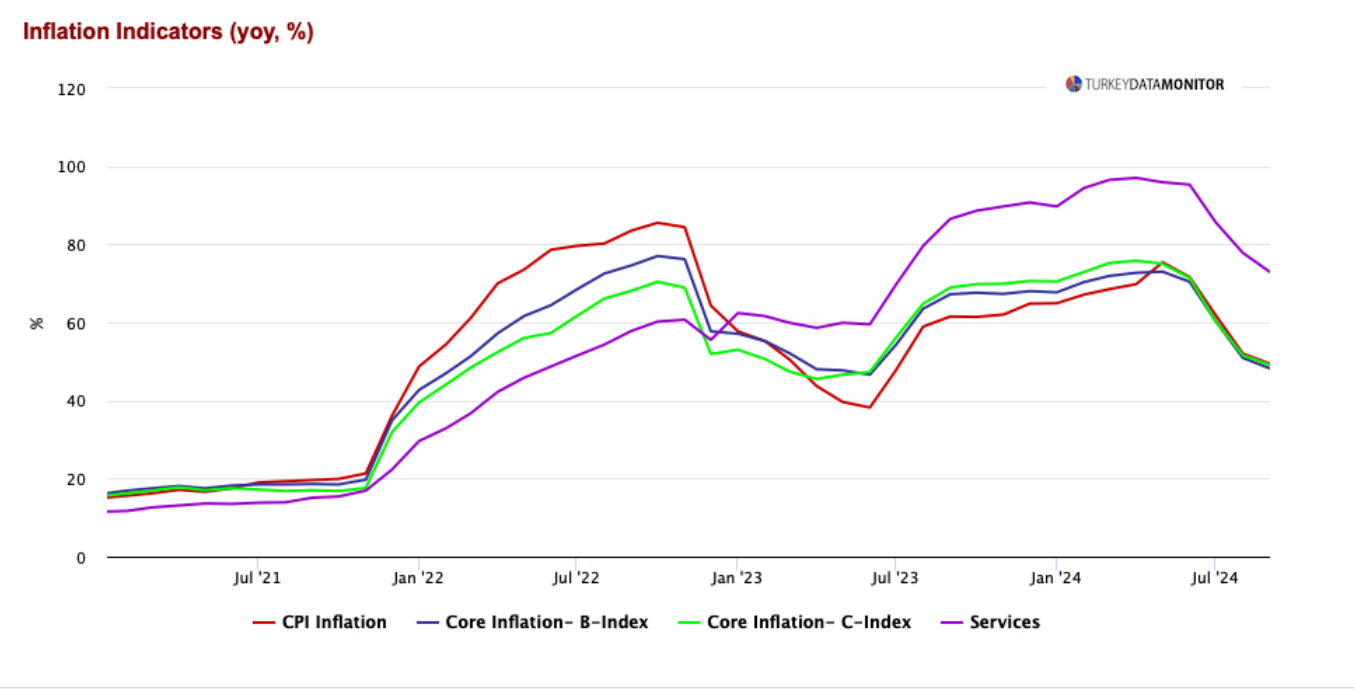

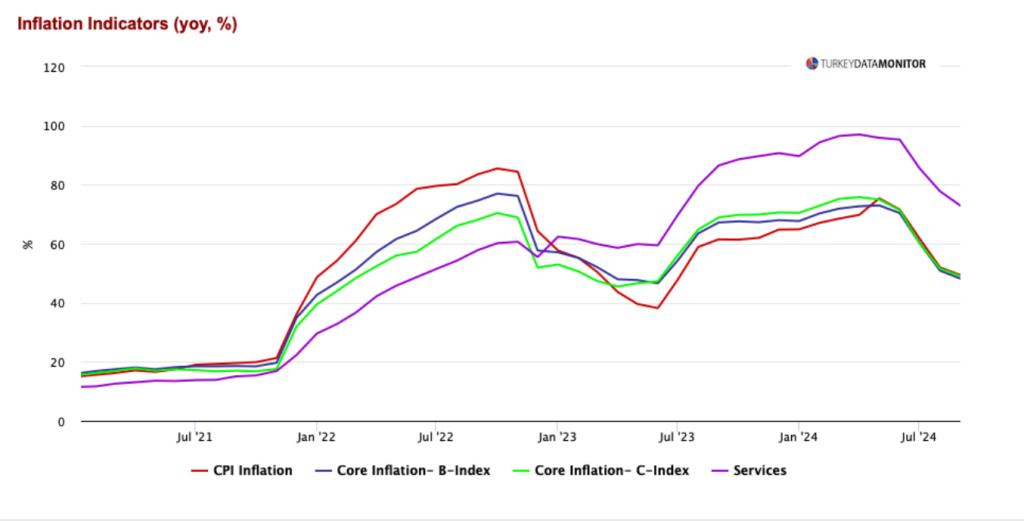

The deviation in inflation forecasts can be primarily attributed to persistent service inflation, which requires a marked improvement in the coming period.

The rigidity in service inflation, our key focus area, once again turned out to be the main culprit behind the forecast miss today. Although service inflation moderated on a YoY basis from 77.8% to 72.9% due to base effects, it was significantly high on a monthly basis at 4.9% MoM, exceeding even last month’s 4.6% print. While a one-off 14.2% increase in education services contributed significantly to this outcome, we observe that price rigidity remains prevalent across other sectors as well. Even when education is excluded, we calculate that MoM service inflation remains elevated, nearing 4.0%. Note that the March-September services inflation average stands at roughly 4.2%, even if we exclude the unusually high figures for January and February (12.1% and 5.7%, respectively).

The current pace for services inflation is significantly high for the CBRT’s projected inflation path, which anticipates that seasonally adjusted monthly CPI inflation declining to about 1.5% in the last quarter. In summary, in order to achieve the inflation targets for 2025 and beyond, a substantial adjustment in service inflation, i.e. a deceleration to at least 2.0%- 2.5% levels, is required.

Food inflation came in at 2.5% MoM, which is largely aligned with our forecast Yet, we should note that this figure materialized before the usual seasonal hikes in vegetable prices expected during the winter months.

Looking ahead, we could witness MoM food inflation at around 3.5%-4.0% in the coming months, driven by seasonal factors. Finally, the recent gradual upward trend in exchange rates has led to notable price increases in durable goods prices (August: 1.5%, September: 1.8%), although these were somewhat below headline inflation.

Assuming that the currency will continue to rise at a similar pace in the coming months, we would anticipate similar levels for the monthly durable goods inflation outcomes.

The current inflation outlook poses challenges for initiating the long-awaited rate-cut cycle within 2024.

Our latest year-end CPI inflation forecast stood at 45%, above the consensus estimate of around 43%. Yet, the recent inflation prints, coupled with the ongoing rigidity in service inflation, suggests rising risks to this forecast, making a year-end realization around 46% more likely. With the current outlook, we could also see the CBRT revise the Medium-Term-Program’s CPI inflation projection of 41.5% higher, when it releases the quarterly Inflation Report on Nov 08. Under these circumstances, market is likely to postpone rate cut expectations to December or even January 2025. Accordingly, the October and November inflation prints, particularly signals related to the service inflation persistence, will continue to be the determining factor for the timing of the first rate cut.

By Serkan Gonencler, Chief Economist, Gedik Invest

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/