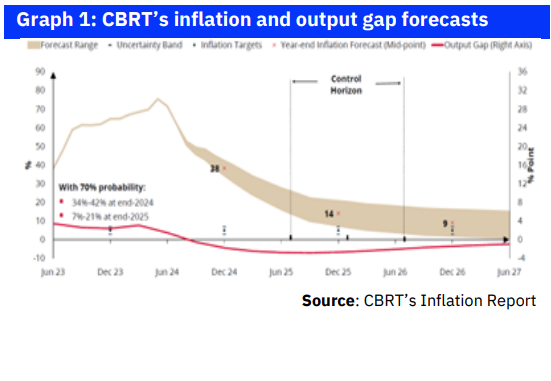

CBRT kept its inflation forecasts unchanged in today’s third Inflation Report of the year. CBRT’s 3-year CPI inflation interval projections are as below

▪ End-2024: 38% (within the range of 34-42)

▪ End-2025: maintained at 14% (within the range of 7 -21), and

▪ End 2026: maintained at 9%.

We think that the decision to keep the 2024 forecast range unchanged may be for preparation purposes for an interest rate cut. Although the CBRT notes that the slowdown in demand and the improvement in the underlying trend of inflation are progressing slower than anticipated (having revised up its output gap forecast), it justifies maintaining the 2024 inflation forecast by citing that the increase in administered and regulated prices (such as electricity and natural gas) has been lower than expected. We consider it reasonable that the CBRT refrained from altering its inflation forecast, particularly the upper bound of the forecast range, to prevent a deterioration in inflation expectations.

However, under current conditions, we believe the lower bound target of 34% has lost its relevance and should have been revised upwards. As of the end of July, cumulative CPI inflation (7-month) stood at 29%, and by August, it is highly likely to approach (or perhaps exceed) 32%. Therefore, even if the upper bound of 42% was kept unchanged, revising the lower bound of 34% and thereby raising the midpoint estimate (38%) would have been a more prudent approach.

Accordingly, we believe that leaving the forecast range unchanged could be seen as preparation for an interest rate cut, as it would have been challenging to justify a rate cut while simultaneously raising the inflation forecast.

The statement from the August MPC meeting could signal the timing of the rate cut process. We expect the CBRT to maintain the phrase “a tight monetary policy stance will be sustained until a clear and permanent decline in the underlying trend of monthly inflation is achieved and inflation expectations converge towards the projected forecast range” in the statement following the August MPC meeting (and in the subsequent months). However, if preparations for rate cuts are underway and, as the CBRT suggested today, there is a noticeable improvement in the underlying trend of monthly inflation, the phrase “should a clear and permanent deterioration in inflation be anticipated, the monetary policy stance will be tightened” should eventually be removed from the statement. If the CBRT removes this phrase from the August MPC statement, it could strengthen market expectations that rate cuts will begin by October at the latest, if not in September.

Nevertheless, we maintain our view that the current inflation outlook does not support initiating a rate cut cycle before November or even December.

By Serkan Gonencler, Chief Economist, Gedik Invest

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/