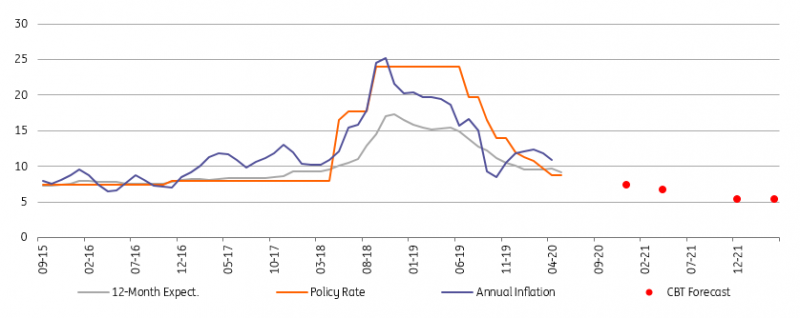

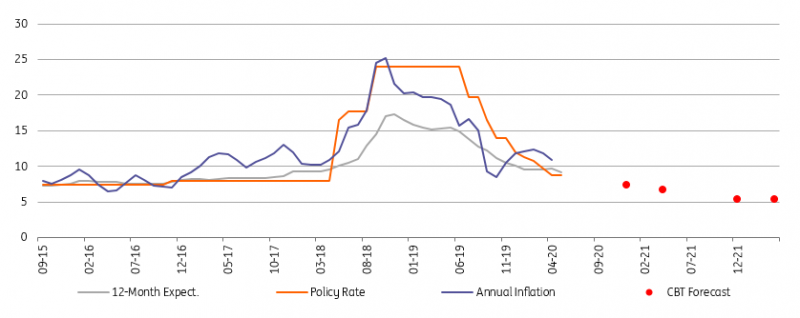

The Central Bank of Turkey extended its easing cycle with an eighth cut last month, reducing the policy rate sharply to 8.75% from 24.0% in mid-2019. This highlights the extent of weakening in economic activity amid the Covid-19 impact as well as the increased downside risks to the inflation outlook. The shift in global policies, meanwhile, has provided room for the CBT to act. We expect the Bank to reduce the policy rate further (1-week repo rate) by 75bp to 8% at the May (Thursday) Monetary Policy Committee, as evidenced by recent revisions to the inflation forecast, which offers room to ease.

In the April inflation report, the CBT revised down its 2020 projections to 7.4% from 8.2% in the previous one. According to the CBT’s inflation forecast trajectory, the Bank expects the downtrend to accelerate from July onwards, towards 8% in September, and to continue falling thereafter, reaching 7.4% by the end of 2020. As a cautionary note, forward-looking expectations remain intact, with 12-month and 24-month forecasts ahead of the consensus, at 9.20% and 8.30%, respectively, while the exchange rate pass-through points to another challenging year, in our view.

In April, annual inflation maintained its downtrend as energy prices fell, while underlying price developments showed an improvement despite the impact of currency movements on certain items. Going forward, softer domestic demand conditions will be supportive for disinflation, along with lower oil prices and their second-round effects. Still, exchange rate developments will remain one of the major determinants of the inflation outlook. We expect annual inflation to be at 8.3% at the end of this year. With the latest inflation data, the ex-post real rate (based on the effective cost of funding rate) stood at -2.6%, close to the lows realised since 2013. However, the CBT continues to focus on the ex-ante real rate to guide its policy decisions and relies on its year-end inflation forecast in real interest rate calculations.

It is possible that the CBT opts not to make any change, or a limited one, as it has already pulled the effective cost of funding below the policy rate with new funding alternatives introduced after the March MPC. Accordingly, the CBT has provided TRY61.4 billion (roughly 40% of the total funding provided to the banking system) via 90-day repo auctions, pulling the effective cost of funding to 8.2% as of 15 May vs the policy rate at 8.75%. There is further room to drive the effective cost of funding by means of the targeted additional liquidity facilities without any further policy rate cut.

Many emerging market economies have reduced their policy interest rates to support growth in recent months, including Turkey, as the CBT swiftly responded to Covid-19 related developments with a series of measures, and maintained its cutting cycle. The Bank will likely continue with additional moves given the extent of coronavirus pandemic effects. The current stance complements a policy mix that aims to mitigate the downside risks to growth, and this does not rule out further rate cuts, in our view. Currency developments that could risk price and financial stability will also be closely watched, though a recent recovery in the Turkish lira after decisions by the Banking Regulation and Supervisory Agency should also be encouraging for the CBT.