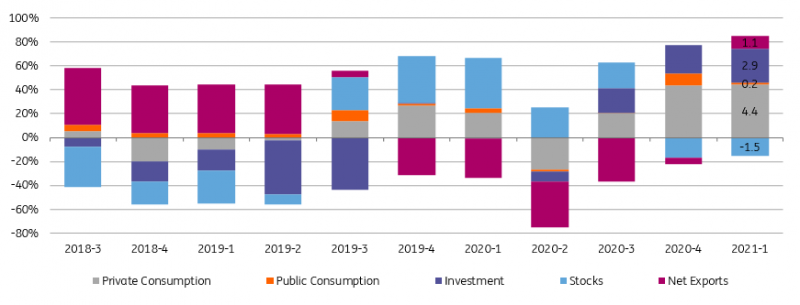

Robust GDP growth at 7.0% year-on-year is attributable to private consumption, gross fixed capital formation, net exports and government expenditures while the contribution of inventory was in negative territory.

As indicated by recent high frequency indicators, GDP recorded another robust growth in the first quarter of this year at 7.0% YoY and turned out higher than market consensus at 6.7% (and our call at 6.2%).

In seasonal and calendar adjusted terms (SA), economic activity continued its recovery with 1.7% quarter-on-quarter growth, close to the performance realized in the previous quarter despite containment measures that were still in place to control the pandemic. A closer look at the seasonally adjusted data suggests that net exports, inventory buildup and capital formation were the main drivers for the sequential growth. On the flip side, household consumption and government expenditures softened in 1Q21.

On the demand side, private consumption maintained its rebound with 7.4% YoY growth after close to double-digit growth rates in the previous two quarters and turned out to be the major driver with a +4.4 percentage point contribution to the GDP expansion in 1Q21. While services consumption has remained weak with a YoY contraction, continuing demand for durable and semi-durable goods has determined the outlook.

Investments also remained on a rapid recovery path with 11.4% YoY, translating into a +2.9ppt contribution to the headline as companies utilized supportive measures implemented by the government in the pandemic environment to improve production capacity. In the breakdown, machinery & equipment investments recorded excessive growth rates in recent quarters, standing at 30.5% YoY in 1Q21, while construction investments were still in negative territory.

Public consumption that has lifted the GDP almost every quarter since the second half of 2017 remained supportive in 1Q21, adding +0.2ppt to the headline, though the outcome shows some momentum loss after a significant +1.0ppt contribution in the previous quarter.

After an inventory buildup since 3Q19 markedly supported the GDP performance, we saw the contribution of inventory draw down in the last two quarters with -1.5ppt in 1Q21. These large impacts of inventories in recent quarters likely reflect some measurement problems.

Finally, net exports turned to positive for the first time since late 2019, raising the headline growth by +1.1ppt. This is attributable to a small rise in imports by 0.8% YoY and a contraction in exports by -0.2% YoY.

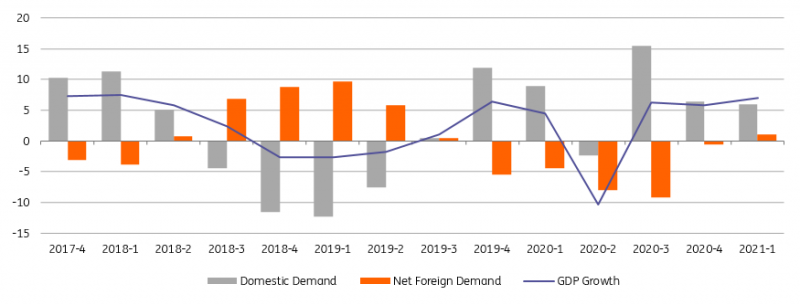

Contributions to Annual GDP Growth

In the sectoral breakdown, all sectors have lifted the headline growth showing the continuation of a broad-based recovery. Among positive drivers, industry was again the biggest contributor, pulling the fourth quarter performance up by 2.5ppt as indicated by industrial production data, followed by services with 1.4ppt. Despite the return of pandemic-control restrictions, the positive contribution from services is also encouraging.

Overall, the data showed a continuation of rebound from the pandemic-induced recession while implementation of quarantine measures to a certain extent limited the 1Q21 performance. Robust GDP growth over the same period last year is attributable to private consumption, gross fixed capital formation, net exports and government expenditures while the contribution of inventory was in negative territory. 2Q21 growth, on the other hand, is likely to be respectable with the gradually waning effects of Covid-19 and a low GDP base in 2020. However, activity is expected to lose momentum on a sequential basis given the impact of high borrowing costs, recent FX volatility and pandemic-control restrictions extending into 2Q21 despite a further rebound in goods and services exports given strong external demand with global activity picking up and a recovery in tourism.