C/A deficit continues to trend down in June and is likely to do so going forward

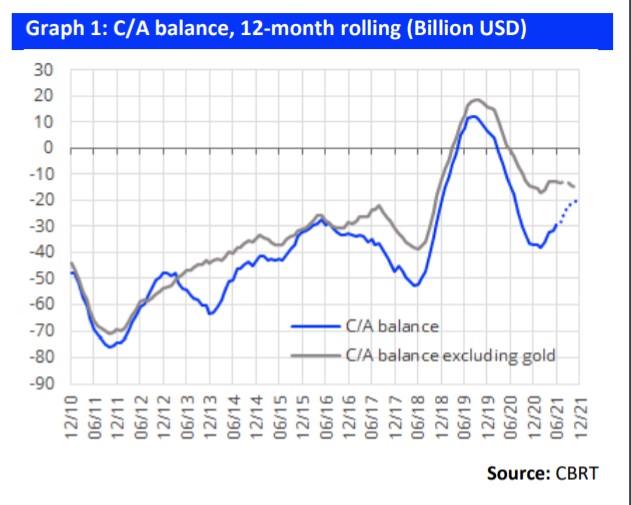

June C/A deficit at USD1.1bn was in line with our and market expectations. In June, Turkey printed a USD1.1bn C/A deficit, in line with our expectation, which is also the median market expectation. This compares favourably with the USD3.1bn deficit registered in the same month of last year, thereby leading to a deceleration in the 12-month rolling C/A deficit to USD29.7bn from last month’s USD31.7bn. The capital account posted a USD7.0bn surplus, mainly with the help of USD3.2bn swap agreement with China and Treasury’s USD1.5bn worth of net Eurobond issuance.

There also seems to be USD2.95bn unregistered inflows (recorded under net errors and omissions item), which also helped a significant rise in official reserves to the tune of USD8.8bn. Meanwhile, the cumulative C/A deficit for the Jan-Jun period reached USD13.6bn.

Deleveraging of the private sector has slowed down recently

WATCH: Turkey’s Annus Horribilis | Real Turkey

In June, both banking and corporate sector reduced their net debt (through loans) by USD400m and USD393m, respectively. Yet, the pace of deleveraging actually seems to have slowed down in recent months compared to the mid-2018-2020 era, especially for the corporate sector. In fact, for the January-June period, the rollover ratio for long-term loan renewals materialized at 132% for the corporate sector and 91% for the banking sector. On a 12- month rolling basis, these ratio stand at 90% for banks and 111% for corporates.

WATCH: A Uniquely Turkish Disease: High Chronic Inflation

C/A deficit continues to trend down in June and is likely to do so in the remainder of the year

We expect C/A deficit to continue trending downwards in the remainder of the year despite rising energy import costs, with moderation in gold imports, improvement in tourism revenues, a likely slowdown in imports in the upcoming months and most importantly robust export performance. Particularly considering the strong export performance in recent months, we continue to expect year-end C/A deficit at USD18-19bn, which is somewhat below market expectations of USD23-23bn. Recall that the CBRT has been referring to its C/A surplus estimate in 2H21, which would also help the disinflation process through a strong(er) TL. As such, CBRT’s C/A deficit for 2021 estimate seems to be around USD12-13bn, well below consensus expectations.

By Inveo Economist Serkan Gönençler

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/