Is Bank Research: Massive improvement in January current account deficit, more to come..

cad-january2024-chart1

cad-january2024-chart1

Current account deficit became 2.6 billion USD in January.

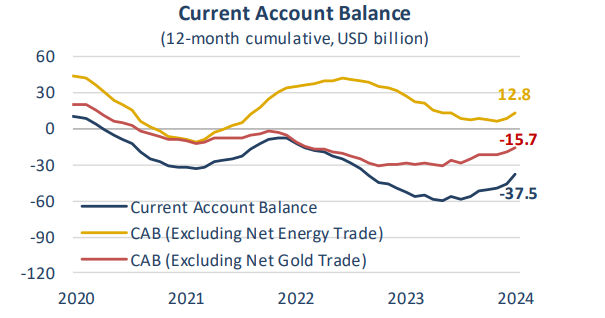

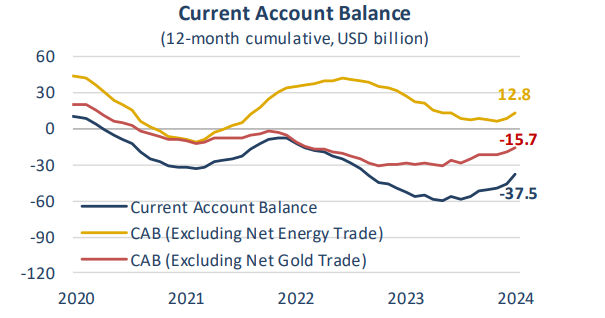

Current account posted a deficit of 2.6 billion USD in January, slightly below market expectations. In this period, current account deficit narrowed by 75.5% yoy, mainly due to the decline in non-monetary gold and net energy imports. In January, net gold imports fell to 936 million USD, the lowest level since April 2022. Thus, current account surplus excluding gold and energy increased by 77.6% yoy to 3.6 billion USD. In January, services balance followed a relatively flat course compared to the same month of the previous year and posted a surplus of 2.8 billion USD, while transportation and travel items recorded a net income of 995 million USD and 2.2 billion USD, respectively. Thus, according to 12-month cumulative figures, current account deficit was realized as 37.5 billion USD in January, the lowest level since August 2022.

Moderate course in foreign direct investments continued.

In January, foreign direct investments posted a limited net capital inflow of 661 million USD. In this period, residents’ net acquisition of financial assets abroad became 249 million USD, while net incurrence of liabilities was realized as 910 million USD. Net real estate investments, which were realized as 415 million USD in January, constituted 45.6% of net incurrence of liabilities. In the same period, non-residents’ direct capital investments in Türkiye increased by 57% yoy to 399 million USD.

Portfolio investments recorded a net capital inflow of 1.1 billion USD.

In January, non-residents’ equity securities portfolio increased by 186 million USD, while their net purchases in debt securities market were realized as 1.7 billion USD. Thus, in the first month of the year, portfolio investments increased by 131.6% on an annual basis.

First capital outflow in other investments since June 2022…

In January 2024, other investments recorded a net capital outflow for the first time since June 2022, with an amount of 3.5 billion USD. In this period, domestic banks’ currency and deposits in correspondents increased by 4.1 billion USD and nonresident banks’ deposits in Türkiye rose by 1.7 billion USD.

In January, banks and the General Government realized net credit utilization of 912 million USD and 17 million USD, respectively, while other sectors realized net repayment of 890 million USD. According to 12-month figures, long-term debt rollover ratio was 121% in banking sector and 93.4% in other sectors.

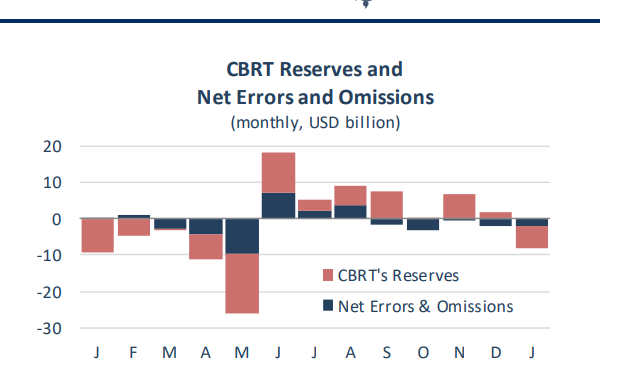

Reserve assets decreased by 6.2 billion USD.

Having increased by 24.5 billion USD in the second half of 2023, reserve assets decreased by 6.2 billion USD in January. Thus, reserve assets contributed to the financing of the current account deficit for the first time since May 2023.

Net errors and omissions item, which recorded capital outflows for the last 5 months, had a capital outflow of 1.9 billion USD in January.

Expectations…

12-month cumulative current account deficit, which has been declining since August 2023, maintained this trend in January.

Moreover, according to the preliminary data released by the Ministry of Trade, exports increased by 13.6% yoy in February, while imports continued to decline by 8.5% yoy. The fall of 5.1 billion USD in foreign trade deficit compared to February 2023 indicates that the 12-month cumulative current account deficit will continue to decline.

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/