- Turkey posted a double-digit monthly inflation for the second consecutive month; this was not seen in the last 40 years

- We see inflation around or above the 50% mark until November

- Policy makers show no intention towards tighter policies and this increases the upside risks to inflation

Summary

Reflecting an almost exhaustive set of demand and supply related factors, consumer prices rose 11.1%m/m, pushing annual inflation to 48.7% in January. This is the first time in 40 years that Turkey had two consecutive months of double-digit inflation. Apart from the seasonal stability in clothing and education prices, monthly price increases were very high across the categories, showing how broad-based inflationary pressures were. The unorthodox economic views of major policy makers, a premature and front-loaded monetary easing delivered by the CBRT, the resulting worsening in inflation expectations and most importantly the sharp currency weakness (which was an aftermath of the factors cited previously) have been the main factors behind the surge in inflation in recent months.

On top of these, January saw significant increases in taxes and administrative price increases in natural gas, electricity, alcohol and tobacco.

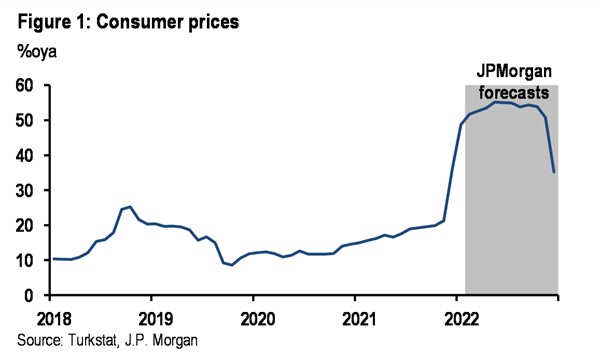

In the absence of any major surprises, we are keeping our inflation forecast unchanged. We see inflation peaking at 55% in May, staying around 50% until November and falling to 35% at the end of 2022 (Figure 1).

There is not much to say on the details of the CPI data in January. Not surprisingly, the prices of FX-sensitive items like consumer durables, energy and travel increased the most, but price pressures were strong across the board. Core CPI increased by 6.9%m/m and annual core inflation jumped to 39.5%. In fact, of the six core indices the Turkstat announces, the most widely-used Core-C had the lowest annual increase. The annual inflation in other core indices was around the 50% mark.

Annual inflation jumped to 76.4% in energy and 55.6% in food. Annual inflation was 55.8% for goods and 29.6% for services and the difference mostly reflected higher global commodity prices and stronger FX pass through in imported goods.

WATCH: Has Erdogan Averted a Currency Crisis? | Real Turkey

Going forward, the recent lira stability will likely mitigate price pressures, but given the ongoing political and policy uncertainties the lira remains vulnerable and fresh FX pass through risks are high. Other demand-led and cost-push factors cited above should remain in place. In fact, annual producer price inflation has reached 95.3% and the difference between PPI inflation and CPI inflation has reached a historic high.

WATCH: TURKEY: Next Stop Is Currency Controls

Hence, cost-led pressures are high and part of this will be reflected into final consumer prices in the coming months. This confirms our view that the risks to the inflation forecasts are skewed to the upside.

Finally, there has been a disconnect between the inflation dynamics and the monetary policy decisions in recent months. The CBRT does not sound concerned about the jump in inflation and there is no reference to tighter policies in the recent CBRT communication. We expect the CBRT to keep rates unchanged until the end of the year. The risk is that of an increase in political pressure for lower rates especially if there is a sharp slowdown in growth.

Follow our English language YouTube videos @ REAL TURKEY:

https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng