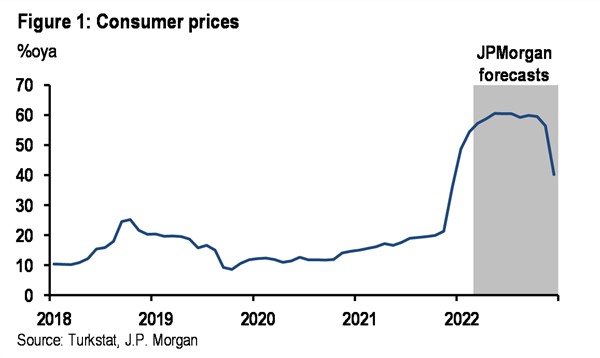

- The upside surprise in February CPI data and the presence of strong price pressures encouraged us to revise the end-2022 inflation forecast to 40.2%

- We see over-year-ago inflation around 60% until the very last month of the year

- Further policy easing looks very unlikely

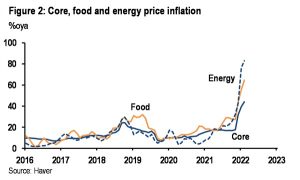

Strong and broad-based price pressures resulted in yet another upside surprise in inflation in February. The 4.8%m/m increase in CPI compared unfavorably with the market consensus of 3.8%. But then, what is a one percentage point difference especially when annual inflation has hit 54%? While annual CPI inflation surpassed 50%, annual PPI inflation reached triple-digits. The 105%oya increase in PPI was the highest in decades and has shown the strength of cost-led inflationary pressures that could feed into CPI in the coming months. Open a textbook and make a list of the factors that cause inflation, you will see the traces of almost all of these factors in recent Turkish CPI data: FX pass-through, elevated global commodity prices, poor weather conditions, robust domestic demand, administrative price hikes, easy monetary and incomes policies, unorthodox policy decisions (that create a positive feedback loop through loss of credibility, higher inflation expectations and a weaker currency).

True, some of these factors will lose momentum in the coming months. If the lira maintains its stability, FX pass through could diminish; higher inflation has eaten away the wage increases and this along with weaker sentiment (which at least partly followed the conflict in Ukraine) should lead to a weakening in demand pressures; and, strong precipitation points to better agricultural output and, hence, weaker prices in the coming months. However, global commodity prices are likely to remain high and the risk of supply disruptions continues. Furthermore, weak policy credibility makes it impossible to anchor inflation expectations.

|

|

In this environment and following the upside surprise in inflation in February, we have revised our end-2022 inflation forecast to 40.2% from 35.7%. We see inflation peaking just above the 60% mark in May, but inflation should remain close to 60% until the very last month of the year. Unfortunately, the CBRT policy decisions have been disconnected from the macroeconomic outlook and thus have become irrelevant in recent months.

Fed Interest Rate Hikes Will Hurt Turkish Economy (And Other Emerging Markets) Badly

We do not expect any policy tightening and see the policy rate unchanged at 14% throughout the year. The volatility in global financial markets, the conflict in Ukraine and strong price pressures at home should make it nearly impossible to deliver further monetary easing even in Turkey.

Follow our English language YouTube videos @ REAL TURKEY:

https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng