JP Morgan: Turkish Banks

jp-morgan

jp-morgan

We upgrade select subs of Turkish large banks from N to OW. For this upgrade we focus on the higher yield / lower cash price bonds. We think credit risks in Turkey haven’t increased materially in the recent weeks. If market conditions stabilise these bonds offer higher upside.

Specifically, we upgrade Garanti’s and Akbank’s T2 subs: GARAN ’22-27 (offered at 99.5, YTC 7.2%), AKBNK ’22-27 (99.375, 9.2%), ’23-28 (99.0, 7.6%) and ’26-31 (95.0, 8.1%).

We remain UW in banks’ shorter-dated seniors (due in 2022-23), however, which we view as not attractive on valuations, and Neutral in their longer-dated seniors and in certain subs. See Table 1 below for a detailed list of our recommendations and changes.

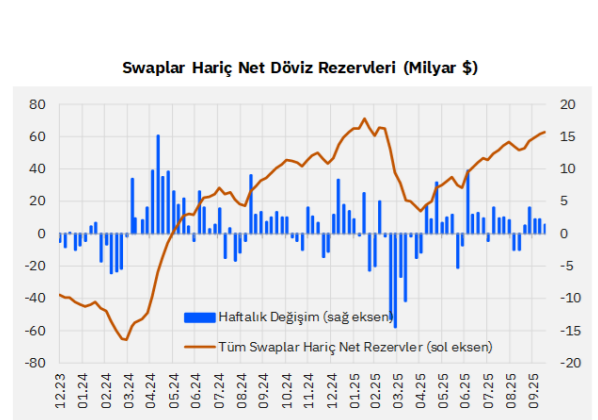

Turkish banks’ (and sovereign) Eurobonds haven’t reacted as much, as in the prior instances of stress. We think this has to do with the improved gross liquid FX reserves position of the central bank and the central bank’s seeming readiness to let TRY adjust and absorb the outflows pressure. Both reduce risks of any financial restrictions prospectively. The central bank disclosed this week that they may intervene to limit excess volatility in the market, which we think is appropriate.

No tightening measures, even unconventional, have been enacted to stabilise the market to date, and the central bank’s readiness to take such actions is unclear, which raises concerns. In this backdrop, if there is another sharp correction in FX (e.g. due to speculations, hedging), this could exacerbate banks’ funding risks (see below), and this in turn is the highest risk for our more positive tilt on the credit.

The deeply negative real rate should prompt an increase in dollarisation over time. A weaker TRY though should somewhat reduce this pressure. As banks should partly mirror the increase in deposit dollariastion by an increase in their position in swaps with the central bank, this should also take some pressure off the FX market.

There are no signs of a funding stress in the banking system at present. The bigger credit concern, in our view, is that the FX move can trigger deposit volatility or an external debt rollover issue, but these risks appear distant in our view. The system was closer to those risks in mid- 2018, but the current market volatility hasn’t been as acute.

Based on the available public data (we look at the daily data for banks’ FX cash holdings) and the feedback from a number of large banks, there has been no evidence of any deposit volatility through mid-day.

JP Morgan