In June, Budget gave a deficit of TRY19.4bn. Albeit there was no consensus available for the data, the Treasury’s cash balance, a leading indicator for the data, posted a deficit of TL26.8bn in June, increasing by TL15.7bn compared to the same period in the previous year. Budget gave a deficit of TRY 12.1bn in June 2019 (May 2020: TRY-17.3bn).

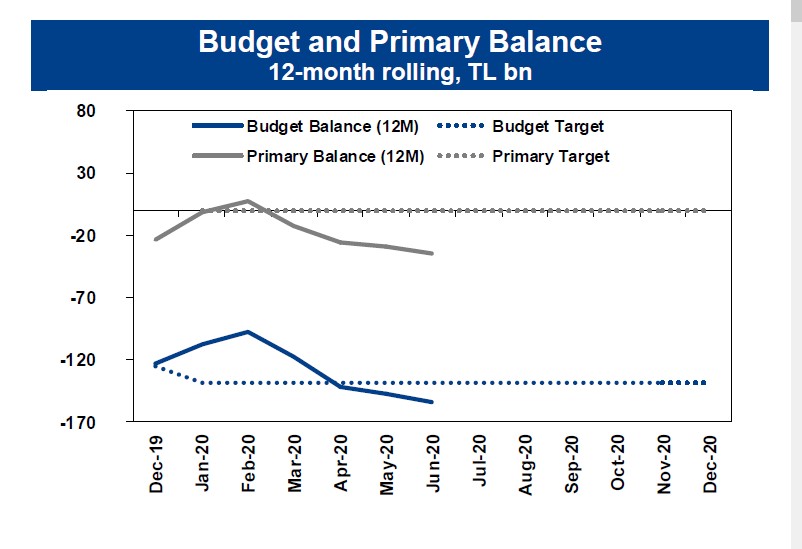

Accordingly, the budget gave a deficit of TRY109.5bn in the first half of 2020 (2019/1H: TRY-78.6bn). 12-month rolling budget deficit increased from TRY147.2bn in May to TRY154.6bn in June (-3.5% of GDP, 2020 official target: TL -138.9bn – budget/GDP: -2.9%). Additionally, the primary balance posted a deficit of TRY13.1bn in June (May 2020: TRY-7.6bn, June 2019: TRY-7.7bn). Thus, the primary deficit reached to TRY38.2bn in 2020/1H (2019/1H TRY-27.8bn). 12-month primary deficit increased from TRY28.7bn in May to TRY34.1bn in June (-0.8% of GDP, 2020 official target: +0.1bn – primary bal. / GDP: 0%).

Import taxes point to domestic demand recovery

Budget revenues increased by TRY10.8bn YoY, up 6% YoY in real terms, to TRY66.3bn. Tax revenues increased by TRY11bn, 10% YoY in real terms, to TRY55.4bn, while non-tax revenues remained stable at TRY10.8bn, down by 9% in real terms. The main drivers on the YoY increases on the tax revenues were tax collections from corporate taxes, foreign trade and Special Consumption Taxes (SCT). We should recall that the weak economic activity in 2019/1H constitutes a low basis for the year-over-year comparison.

Robust import tax revenue figures could be seen as a result of the recent recovery signs in the economic activity with the gradual ease in the social distancing measures since May and strong loan growth which lead to increase on the imports. Additionally, the recent upward momentum on the automotive and durable goods due to the sectoral incentives after the pandemic were the key drivers of the improvement in the SCT figures. On the other hand, the ongoing weak outlook on the Value Added Tax (VAT) deserved attention despite the low basis in 2019/1H.

Expenditure growth driven by state aid

Budget expenditures increased by TL18.1bn YoY, up 13% YoY in real terms, to TL85.6bn. Non-interest expenditures increased by TL16.2bn YoY, up 12% YoY in real terms, to TL79.3bn, while interest expenditures increased by TL1.9bn YoY, up 28% YoY in real terms, to TL6.3bn. The key drivers of the increasing budget expenditures were current expenditures (mainly driven by Treasury aids and incentive payments on agriculture), capital expenditures (real estate capital and production expenditures ) and personnel expenditures in June.

Negative pressures on budget will be in the foreground until 4Q

We believe that the recent deterioration on the budget was not a surprise when we take into account the increasing need of economic support due to the pandemic and the last Treasury’s cash deficit figures. The reflections of the recent recovery trend in the economic activity, which was driven by loan growth and some sector specific incentives, was seen on the revenues side.

However, YoY drop in VAT revenues, despite low basis due the weak economic activity in 2019/1H cast shade on this improvement. We expect the negative impact of the pandemic continuing to apply negative pressure on the budget outlook until Q4 at least. As a result, the budget deficit-to-GDP ratio could rise to around 3.8 – 4% at the end of the year.

EROL GÜRCAN, YF Invest , Director

You can follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/