Turkish manufacturers continued to expand production at the end of the second quarter of the year as demand improved further. That said, new order growth softened in June amid the impacts of currency depreciation, which also led to a renewed strengthening of price pressures.

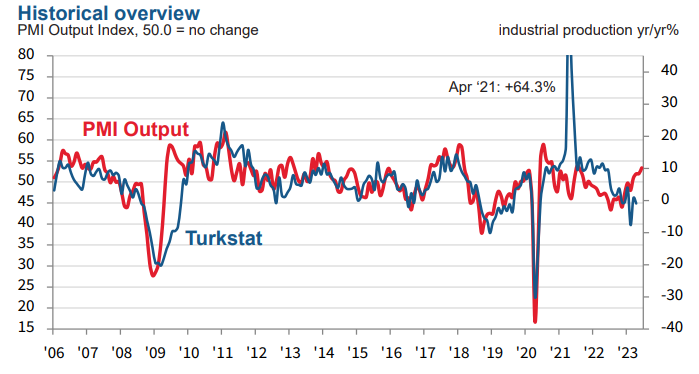

The headline PMI posted at 51.5 for the third month running in June, signalling a further modest improvement in the health of the manufacturing sector. Business conditions have now strengthened in each of the past six months.

The main positive from the latest survey was a solid and accelerated rise in manufacturing production.

Output was up for the fourth month running, with the rate of growth the fastest since July 2021. Alongside improvements in demand, firms also attributed the latest rise in production to an ongoing recovery from the earthquake and a pick-up in activity following the election period.

While new orders rose for a fourth straight month, the rate of increase was only marginal and the softest in the current sequence of expansion. The slowdown in growth was partly reflective of a depreciation of the Turkish lira against the US dollar, anecdotal evidence showed.

Exchange rate fluctuations also contributed to reaccelerations in both input cost and output price inflation in June after sustained slowdowns in previous months. Input prices increased at the fastest pace in just under a year, while charges were up to the greatest extent since February.

Meanwhile, suppliers’ delivery times lengthened markedly as vendors struggled to respond to increasing demand for inputs. Accordingly, firms used existing holdings of items to support production, leading to a reduction in stocks of purchases.

Job creation was signalled for the second month running in response to greater production

requirements. The rate of expansion was modest, but slightly faster than that seen in May. Backlogs o work increased, however, for the second time in the past three months.

Commenting on the Istanbul Chamber of Industry Türkiye Manufacturing PMI survey data, Andrew Harker, Economics Director at S&P Global Market Intelligence, said:

“Manufacturing production kicked on nicely in June, and the goods-producing sector as a whole finished the first half of the year in broadly positive shape as demand improved further. Firms were battling the familiar foe of currency weakness, however, which limited new order growth and brought an abrupt halt to the recent easing of inflationary pressures.

More positively, manufacturers continued to expand their employment levels and purchasing activity, suggesting that they remained optimistic about prospects for the second half of the year.”