TL weakness hardly offset by weak demand: Inflation strong

IMG_8907

IMG_8907

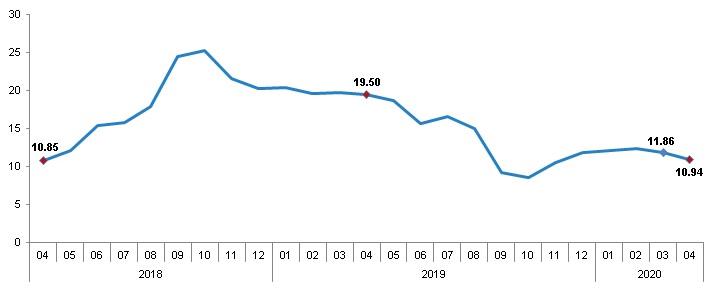

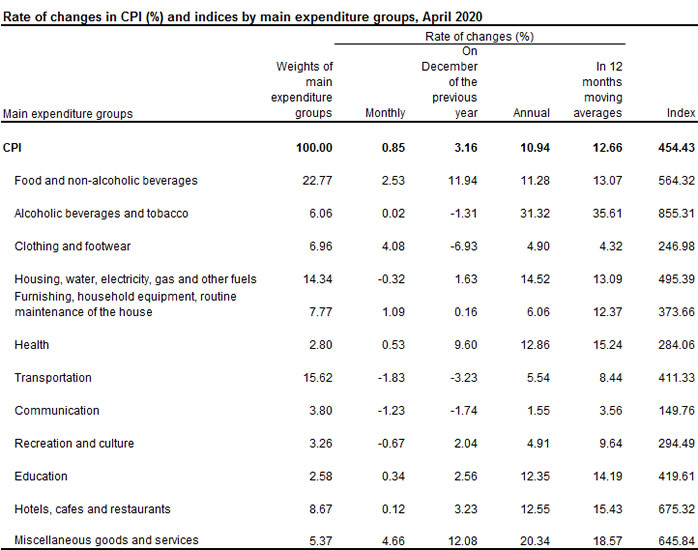

Turkey’s April Consumer Price Index (CPI) increased by 10.94% annually and 0.85% monthly which beats the 0.65% market expectation. On 12 months basis Turkey’s CPI inflation is very high at 12.66%.

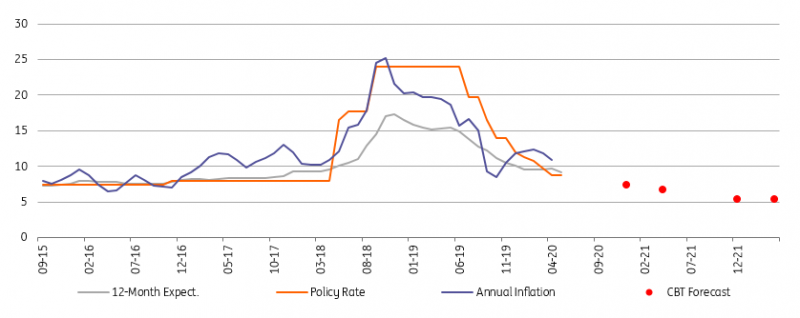

Given the central bank’s recent revision to its inflation expectation from 8.2% to 7.4% along with its second Inflation report of the year that carves the path for even further rate cuts, Turkish lira weakened on the inflation data extending losses beyond the 7.00 against the USD.

The down revision in the central bank's inflation expectation for YE2020 was based on weaker domestic demand amidst the corona virus, the oil shock and tame food price inflation (revised down to 9.5% from 11%).

Looking at the inflation details below, the food price inflation is far from tame. The crash in the price of oil has helped yet, the 15% TL deprecation year-to-date against the USD remains as a force to drive prices up. Despite the sticky core inflation at 11.3%, the expectation that end of year CPI inflation would ease to 7.4% means that the central bank of Turkey will keep on slashing its policy rate by another 150-200 basis points rapidly in the coming months from the current 8.75%. The sharp contraction in domestic demand will ease the pace of inflation down to circa 8.5%, thus negative real rates will persist. Combined with Turkey’s rapid depletion in its fx reserves on the central bank’s quest to guard for Lira, TRY is set to weaken beyond the so-called “psychological threshold” of 7.00 against the USD down the year.

Beyond 2020, the expected mild correction in the price of oil, revival in domestic demand as the corona-crisis erodes and the new round of TL weakness will work as factors that will pull up Turkey’s CPI inflation rapidly back into single-digit territory. As the President wants Turkey’s growth at and above 5%, it would be interesting to see whether the central bank of Turkey would be able to pull p its policy rate in an effort to cap a rising inflation in the country.

Annual rate of changes in CPI (%), April 2020

Among the sub-sectors, the 2.53% incline in the food price inflation is disturbingly high given the seasonal factors that bring the annual food price inflation to 11.28%.

Along the same line, miscellaneous goods and services with 4.66%, clothing and footwear with 4.08% and furnishing, household equipment and routine house maintenance price increase with 1.09% also stand out as the drivers of April inflation.

CPI monthly rate of changes in main groups (%), April 2020

In April 2020 within average prices of 418 items in the index, the average prices of 87 items decreased and the average prices of 61 items remained unchanged while the average prices of 270 items increased.

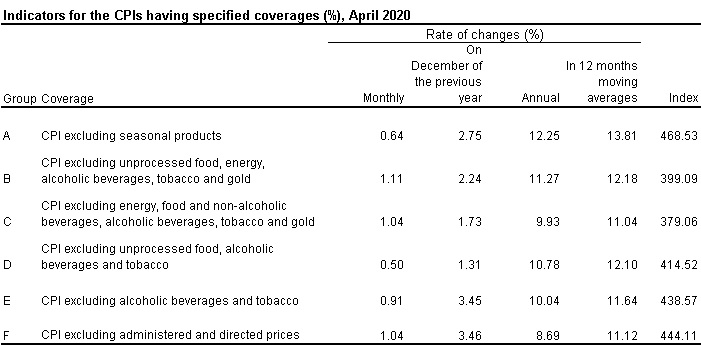

Core inflation (Index B= The CPI excluding unprocessed food, energy, alcoholic beverages, tobacco and gold) increased 1.11% monthly and by 11.27% annually versus 11.65% in March and 10.76% at YE2019.

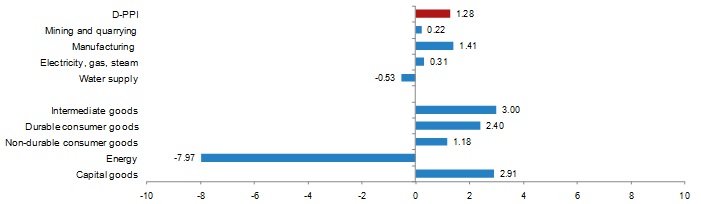

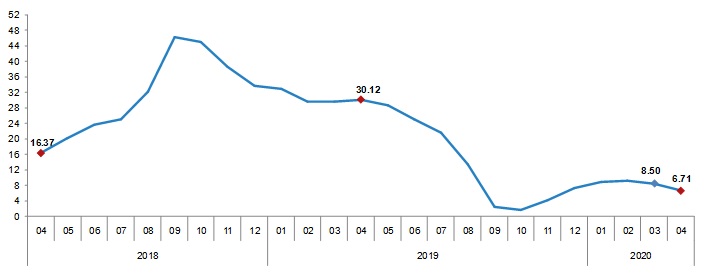

As for the producers’ prices, D-PPI increased by 1.28% on monthly basis and by 6.71% annually. On 12 months average basis, Turkey’s D-PPI remains in double-digits at 10.87.

D-PPI annual rate of change (%), April 2020

Given the oil shock, not surprisingly, coke and refined petroleum products inflation was down by 28.46%, and crude petroleum and natural gas price inflation was -27.71%; capping the headline D-PPI. Yet, the manufacturing price inflation on monthly terms was up 1.4% (6.3%, annually). Similarly, intermediate goods price inflation was up 3.0%, durable consumer goods price inflation up by 2.4% and non-durable goods manufacturing price inflation was up 1.2%; all monthly terms.

D-PPI monthly rate of changes (%), April 2020