Investors are trying to gauge when the macro policies will bare fruit and the timing of the interest rate cuts…

As we have argued in a number of our publications so far this year, particularly since the Turkish government switched to orthodox economic policies and raised interest rates, we have been cautious on Turkish equities based on the fact that: (1) the competitive environment from alternative local money markets, particularly deposit rates, (2) pressure on earnings due to their high base and slower economic growth, (3) slower global growth creating a challenge on exports, and our belief that a future economic re-rating was priced in and the risk reward profile was insufficient.

➢ Consequently, following a strong performance in 2023 and the first five months of 2024, over the last 3 months, stock prices have lost their momentum and were flat in Lira terms, indicating a substantial underperformance against the local deposit rates, which yield over a 5% monthly return. During the same period, the BIST underperformed the EM’s by 6%.

At this stage, the government maintains its utmost commitment to fight inflation.

Local demand started to moderate, and more importantly, earnings should be impacted and fall from its high base. Consequently, in 2024, we expect a real 34% earnings contraction (rose from -24% 3 months ago) in earnings and a 12%+ contraction (-5% 3 months ago) in EBITDA. Note that banks, which are having a sluggish earnings year on lower margins and will be switching to inflation accounting reporting standards by the end of this year are not included in this calculation. Hence, the stock market may be prone to volatility in upcoming earnings seasons until there is clarity as to where earnings will bottom out.

We believe that the investor community views 2024 as a transition year for Türkiye, with a key focus on the results of current macro policies and visibility for 2025-2026.

As such, a sustainable and sharp earnings-based correction is unlikely in Turkish stocks. On the other hand, we continue not to expect a top-down return potential in excess of current local deposit rates until expectations for rate cuts begin and earnings bottom out. We expect earnings to bottom out in Q1 2025, whereby rate cut expectations could begin in Q4 2024.

➢ In terms of our estimates and comparable multiples (in 2 year real terms) we observe that Türkiye is likely to experience a slower period compared to its peers and appears to be trading fairly. On the other hand, if our 2025 estimates hold, Turkish stocks indicate substantial potential by trading near a circa 60% discount to its EM peers.

Our BIST-100 target raised to 13,086 from 11,900 – upside 32%.

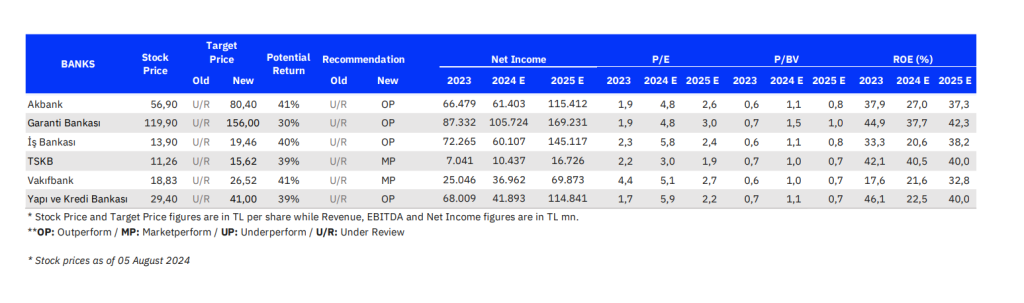

➢ Consequently, our upside is 37.1% for Banks, 30.8% for industrials, and 30.3% for conglomerates.

Sectoral Outlook

➢ Our analysis shows in 2024, due to a higher rate cycle and lower demand real earnings could drop by 34%+ and EBITDA by 12%+. The Iron and Steel, food retail, beverage, and telco sectors stand out and could provide in line and/or or slightly higher growth rates than inflation rates.

Our Model Portfolio: Removing İs Bank

➢ We are excluding the stock following the uncertainty in its partial demerger and weak margins in the core business. At this stage, we are not holding any banks in our portfolio as the sector seems to be pricey at this stage.

➢ We continue to be quite selective in our model portfolio as we focus mostly on (1) companies with a visible growth outlook, (2) stocks which have underperformed and/or trade at low multiples, and (3) companies with probabilities to be exposed to earnings upgrades in the future.

By Ali Kerim Akkoyunlu, Research Director, Gedik Invest

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/