Following the announcement of measures to support the lira last year, relative stability has returned to Turkish financial markets. Policymakers maintain hopes of boosting exports to achieve FX and price stability. However, risks are on the rise

Inflation is on the rise

Annual CPI inflation has maintained a rapid rise since last October and has reached 54.4% – the highest in the last two decades. Inflation in the last four months, on the other hand, stood at 36.9%, reflecting the impact of worsening inflation expectations, the pass-through from currency weakness in the last quarter of 2021 – attributable to deep monetary easing delivered by the CBT, along with large administrative price hikes. Following these developments, trend inflation that had been at high single digits in the past is now estimated to be around 20%, confirming a need for policy reversal towards a more restrictive stance.

Ukraine Crisis Could Cost Turkey $30 Billion | Real Turkey

On the other hand, market forecasts for year-end inflation rose to 40.5% in March, while 12-month and 24-month expectations stand at 26.4% and 17.0% respectively. These show that inflation expectations are high and unanchored given that the current policy framework does not directly address disinflation.

It is not only rising inflation expectations and the FX pass-through, but also other demand-pull and cost-push factors – including rapid uptrend in global commodity prices – which have increased inflation significantly. Given the broad-based deterioration in price dynamics, risks continue to lie significantly on the upside.

Closing the section on prices, higher inflation, leading to even deeper negative real rates, should cloud the currency outlook and raises significant challenges to the current policy framework.

Current account deficit expands rapidly

The 12-month rolling current account (c/a) balance showed a significant improvement last year. Driving that was:

A narrower goods deficit despite surging energy imports, thanks to an improved gold balance and rapid export growth.

The sharp recovery in the services balance on the back of tourism and transportation revenues. Accordingly, the deficit narrowed to $-14.9bn at the end of 2021, translating into 1.9% of GDP.

However, the c/a deficit recorded a sharp expansion in January with the worst monthly figure since the end of 2017. And the deficit widened back out to above $20bn on a 12-month rolling basis mainly on the back of a more than quadrupled (over the same month of 2021) energy deficit and a decline in core trade surplus.

Given that negative real rates reduce the incentive to save, and oil prices are on the rise, the external balance will remain under pressure in the near term. The outlook for the whole year will be determined by tourism revenues and oil. The risk of oil prices remaining higher for longer given the ongoing conflict between Russia and Ukraine will be a negative, while the slowdown in economic activity and weaker core imports can be a limiting factor.

Growing risks to the current policy framework

As long as the government can limit the inflation uptrend as well as the widening of the external deficit, the current policy framework can be sustained for longer. However, as we discuss above, challenges are growing on both the inflationary and external sides. Furthermore, the outlook for these two variables is concerning:

Meet the Person Who Can Beat Erdogan: Kemal Kilicdaroglu | Real Turkey

1) Acceleration in lending:

Looking at the latest data, we see:

Signals of re-acceleration in TRY corporate lending momentum with the Credit Guarantee Fund (CGF).

Credit card momentum remains strong showing the appetite for consumption amid rapidly deteriorating inflation expectations and a wave of price hikes.

A deceleration in general purpose loans

Normally, the CBT communication is that “balanced growth in commercial and retail loans is a requirement for price stability and financial stability”. This implies selective lending on the commercial side and a restrained retail lending expansion. However, further acceleration in TRY corporate loans within the CGF package can undermine the selective growth strategy with a stronger and wider stimulus than anticipated earlier.

One major risk attributable to the acceleration in lending is that it can feed into local FX demand and increase inflationary pressures via accelerating domestic demand and a weakening TRY. It can also pressure the current account balance if we see real lending growth.

2) Geopolitical Issues:

The ongoing conflict between Russia and Ukraine can pose significant risks to Turkey via:

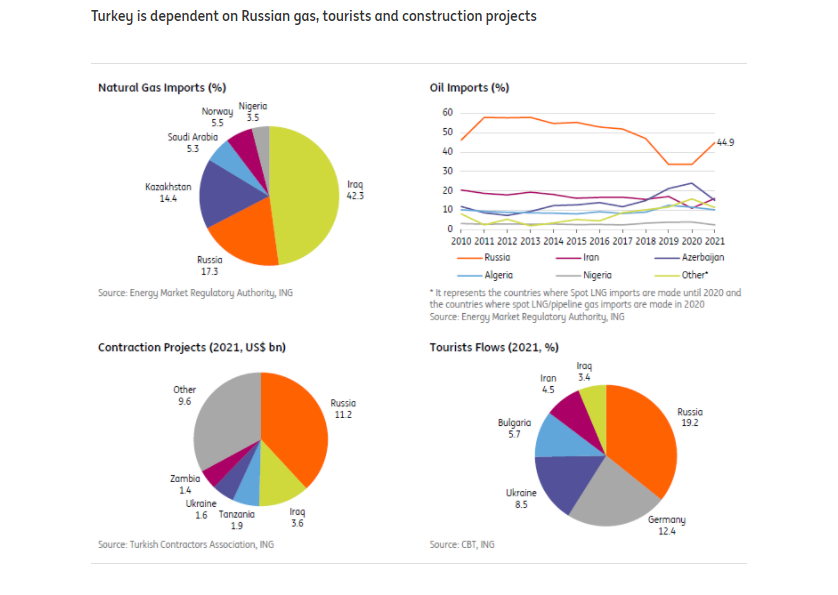

Trade: While trade with Ukraine is relatively low and balanced, Russian trade is large and more concentrated given Russia’s high share of energy in Turkish imports. According to 2021 data, Russia is the main supplier of Turkey’s 44.9% of natural gas imports and 17.3% of oil imports. Additionally, Turkey relies on agricultural imports from both countries with a significant share of wheat in the total.

Tourism: Tourists from Russia and Ukraine constitute 19.2% and 8.5% of the total, respectively, based on 2021 data.

Turkey’s Energy Shortage Reaches Critical Point | Real Turkey

Construction projects: Total volume of projects secured by Turkish contractors from Russia in 2021 is at $11.2bn ($4.6bn in 2020), translating into 38.2% of the total (30.1% in 2020). The deteriorating outlook for Russia is likely to weigh on the initiation of new large projects.

Pressure on oil prices: The rise in energy imports was the main driver of the c/a deficit, while 12-month trailing energy imports are on an uptrend in recent months to $56.9bn in January from $27.1bn in February 2021. The latest spike in energy prices should add to Turkey’s fragility.

Higher risk premium: Turkey’s five-year CDS premium has spiked over recent weeks, which should further increase external borrowing costs for Turkey in the period ahead.

This backdrop supports views for increasing inflationary problems and widening external imbalances. Despite the acknowledgement of geopolitical risks in the latest Monetary Policy Committee statement, the CBT’s general assessment for the macro outlook has remained broadly unchanged. For the future course of inflation, the bank continues to be quite optimistic, restating that it sees the start of the disinflation process on the back of measures taken by the policymakers along with supportive base effects and “the resolution of the ongoing regional conflict”. For the current account, it dropped the expectation of a surplus this year, though maintained its emphasis on the importance of a sustainable current account balance for price stability.

3) Shift in global central bank policies:

As of January, and on a 12-month rolling basis, $18.8bn reserve accumulation was realised. Helping this were $8.9bn in net errors and omissions, relatively higher capital inflows at $30.2bn, and a narrowing in the c/a deficit. These numbers still show a challenging picture for external financing given the reliance on the contribution from the CBT’s swap deals at roughly $5.0bn and the IMF’s SDR allocation at $6.3bn for Turkey. However, we saw a strong long-term debt rollover rate for corporates at 134% (vs 138% in January alone), while the same ratio for banks stood at 95% (106% in January). Trade credits have also markedly expanded at $13.6bn versus a slight contraction over the same month of 2021.

For the coming months, the expected tightening of global central bank policies can increase challenges for Turkey given the still large external financing requirements. Given this backdrop, focus on external financing will likely shift to roll-overs rather than portfolio flows.

Follow our English language YouTube videos @ REAL TURKEY:

https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng