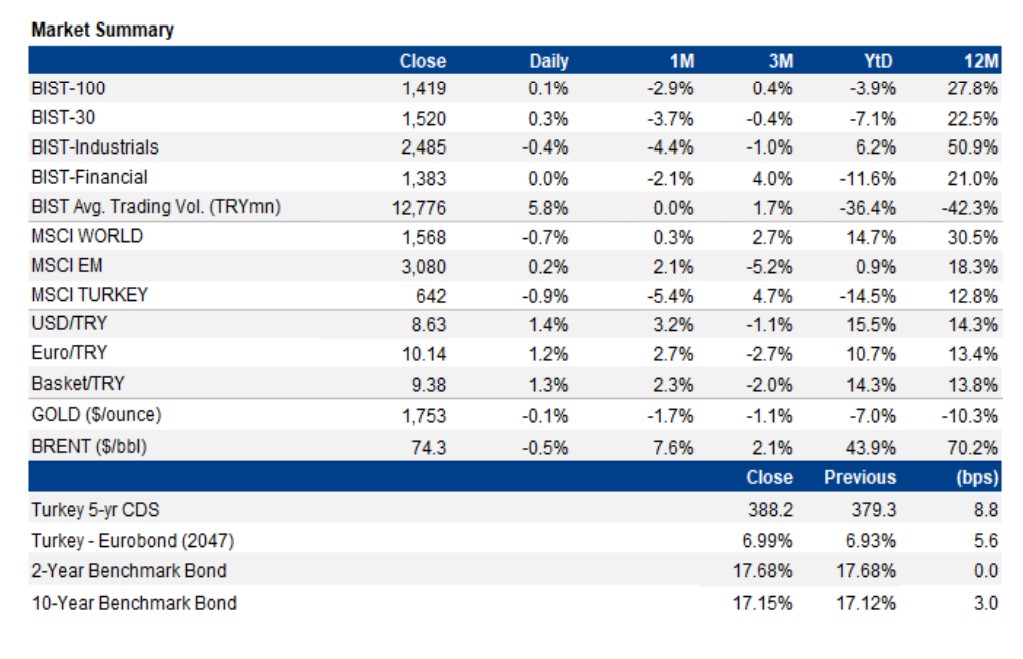

MSCI Turkey underperformed the MSCI EM by 1.1% on Friday. BIST-100 gained 0.1%, closing at the level of 1,419 with a trading volume higher than the last 5 days’ average. Banking index lost 0.6% and industrials index lost 0.4%. Interest rate on 2-year benchmark bond rate remained stable at 17.68% while 10-year bond rate inched up to 17.15% (up 3bps). TRY depreciated by 1.4% vs USD to 8.63 on Friday, while trading around 8.71 this morning.

In terms of local dataflow, International Investment Position (July), Central Government Debt Stock (August), Treasury Issue: Fixed Coupon GB (20.9.2023), Treasury Issue: CPI Indexed GB (14.1.2026) would be watched today. We expect a negative opening for Turkish equities.

Today, Treasury’s issues would be followed

Treasury would issue 2-year fixed coupon G-bond (TRT200923T18) and 4-year CPI Indexed G-bond (TRT140126T11). After these issuances 5 of 8 scheduled auctions for September to be completed.

President Erdogan would join UN General Assembly in New York

President Erdogan went to the US due to the United Nations General Assembly. Today, President Erdogan would join an opening ceremony of a new Turkish House in New York. President would give a speech at the UN General Assembly tomorrow and would attend an investor conference which organized by TAİK (Turkey-U.S. Business Council). President Erdogan said on Sunday that he would meet Greek Prime Minister Kyriakos Mitsotakis on the sidelines of the United Nations General Assembly this week in New York.

England removed Turkey from red travel list

This decision could be slightly positive on Turkey’s tourism revenues. However, we should state that this possible positive impact could be extremely slightly due the high tourism season has been almost come to an end.

WATCH: Turkey’s New Economic Program Explained | Real Turkey

BRSA lowers max consumer loan duration and extends flexibility over NPL recognition, CAR calculation rules

The Bank has lowered maximum duration on consumer loans over TL50,000 from 36 months to 24 months, while announcing no change in required reserve rules for the said loans. The Bank has extended the NPL recognition rule that had raised the unpaid period from 90 to 180 days indefinitely for the outstanding loan portfolios (except consumer loans) as of 1st October and ended this advantage for new loans. The Bank also extended indefinitely, the method of exchange rate calculation used in valuation for risk weighted assets (RWA) in CARs to past 252 working days average. We do not expect the consumer loan duration change to have a major impact on consumer loan demand, whereas NPL recognition and RWA calculation rule extensions would help keep cost of risk at low and CAR at higher levels for banks. Positive.

Yatırım Finansman Securities Daily Report

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/