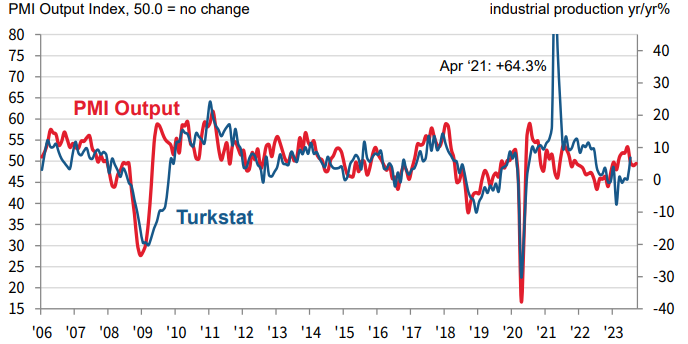

Business conditions in the Turkish manufacturing sector moved closer to stabilisation at the end of the third quarter of the year amid less pronounced slowdowns in output and new orders during September. Employment continued to rise, albeit fractionally. Meanwhile, rates of both input cost and output price inflation softened sharply over the month.

The headline PMI rose to 49.6 in September from 49.0 in August, and signalled only a marginal

moderation in the health of the manufacturing sector. In fact, the latest reading was indicative of business conditions moving closer to stabilisation.

The health of the sector has now softened in three successive months. Production eased for the third month running, but only marginally and to a lesser extent than in the previous survey period. Where output moderated, this was generally a reflection of weak market conditions and a slowdown in new orders. On the other hand, some firms saw demand hold up over the month.

Both total new orders and new export business eased further in September, but at a softer pace than in August. A common theme among anecdotal evidence from panellists was that price pressures had restricted customer demand.

Input costs continued to rise sharply at the end of the third quarter amid ongoing currency weakness.

The rate of inflation was much slower than in August, however, and the weakest overall since May. In turn, the pace of output price inflation also eased markedly from the previous survey period.

Latest data pointed to a fractional rise in employment, extending the current sequence of job creation to five months. Some firms highlighted the need for additional workers, but others scaled back staffing levels amid softer new order inflows.

Firms continued to moderate their purchasing activity and stocks of inputs amid weakness of new orders, although the respective slowdowns were less pronounced than in August.

Where inputs were purchased, manufacturers were faced with delivery delays, as has been the case throughout 2023 so far. According to respondents, the latest decline in vendor performance was due to high transportation costs and difficulties importing goods.

Commenting on the Istanbul Chamber of Industry Türkiye Manufacturing PMI survey data, Andrew Harker, Economics Director at S&P Global Market Intelligence, said:

“There were signs of stabilisation in the Turkish manufacturing sector during September as some firms reported that demand had held up well over the month. Although business conditions remained challenging overall, the latest data provide some hope that a return to growth can be recorded before the end of the year. One help to firms in September was a marked easing of inflationary pressures amid some relative currency stability.”