Turkey manufacturing PMI reported its poorest showing in September, collapsing from 47.8 to 44.3 between August and September. A lesser-known composite PMI survey published by conservative MUSIAD business association, called SAMEKS or PUMAX also reported a decline, albeit much smaller in magnitude. On the spending side, the end-September reading of consumer confidence index compiled by private broadcaster BloombergHT soared to a three month high.

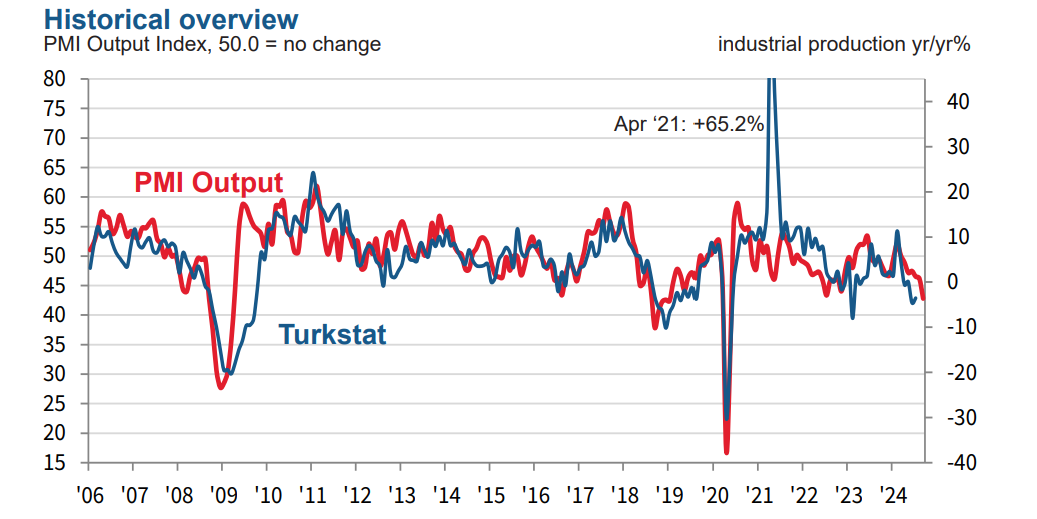

According to the bulletin put out by Istanbul Chamber of Industry and S&P Global, “ The headline PMI dropped to 44.3 in September from 47.8 in August. The latest reading signalled a marked slowdown in the sector, and one that was the most pronounced since May 2020. Business conditions have now moderated in six successive months.

There were widespread reports of demand weakness in September, leading to the sharpest slowdown in new orders in almost four-and-a-half years. Subdued demand in international markets was also signalled by a renewed moderation in new export orders”.

And

“Currency weakness and higher raw material prices led to a further increase in input costs during September. The rate of inflation remained marked, despite easing to a three-month low. In turn, output prices also rose, with charges increased at a broadly similar pace to August”.

Commenting on the Istanbul Chamber of Industry Türkiye Manufacturing PMI survey data, Andrew Harker, Economics Director at S&P Global Market Intelligence, said: “The latest PMI data paint a worrying picture for Turkish manufacturers as the sector moved deeper into its period of moderation at the end of the third quarter. Many firms reported demand weakness, and the struggles to secure new business led them to scale back output, employment and purchasing again.

“While inflationary pressures aren’t currently as severe as they have been in recent years, the still marked increases in prices won’t be helping to improve the demand environment.”

Publishers of SAMEKS composite PMI noted: SAMEKS Composite Index decreased by 0.2 points compared to the previous month in September 2024, falling to 46.5 and continued to remain below the reference value (50).

SAMEKS Index in the industrial sector fell to 44.6 in September, with a 1.0 point decrease compared to the previous month. The 3.7 point loss in the industrial sector, especially in new orders, attracted attention as this sub-index dropped to 40.9 points.

Service Sector SAMEKS Index decreased by 1.1 points in September compared to the previous month, falling to 45.7 points.

According to a BloombergHT report: Bloomberg HT Consumer Confidence Index increased compared to the previous month to reach 66.54 in September.

After a few months of decline, consumer confidence recovered slightly and started to follow a horizontal course as of mid-August. We see that this trend accelerated in the second half of September-100 is the dividing line between optimism and pessimism.

The increase in the current consumption seems to be the main reason for the upward movement. We can say that the slowdown in the economy is the main factor that continues to reduce 12-month ahead expectations for economic outlook.

Current nominal and real interest rates compared to still rising household inflation expectations and the flat course of exchange rates seem to have triggered the increase in consumption tendency in the last two months.

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/