TURKSTAT announced the manufacturing sector capacity utilization (CU) rate and the real sector confidence index for June today, which along with the electricity consumption data suggest that the sequential improvement in economic activity getting more pronounced, but current levels still remain well below levels reached ahead of the pandemic. On the other hand, weekly credit card spending (as of 19 June) has reached very close to levels realized prior to the pandemic.

After the seasonally-adjusted manufacturing sector capacity utilization (CU) rate improved slightly to 62.7% in May from April’s trough level of 61.9%, the sequential improvement turned out to be more pronounced in June, with the CU rate reaching 65.8%. Yet, this still points to about an 11% pts YoY deceleration (implying only a slight improvement compared to the roughly 13% pts YoY decline registered in April and May), and is also well below the 76.6% reached in February, prior to the pandemic.

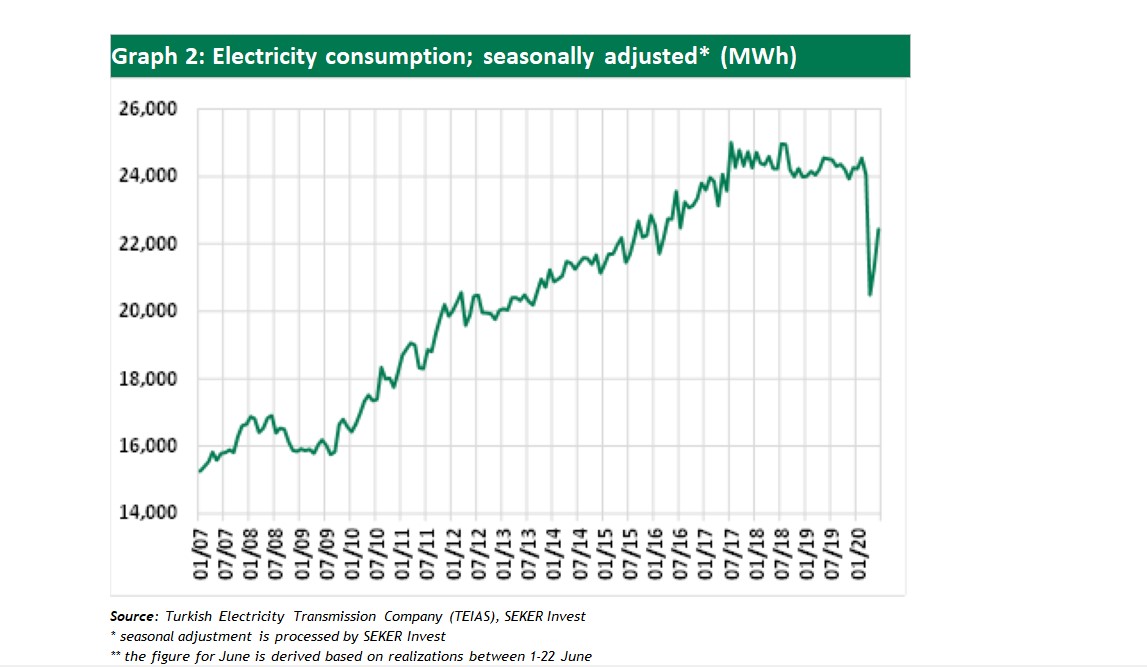

This sequential improvement is actually unsurprising given the normalization steps and the return to work of many firms as of 1 June. The sequential improvement is also visible in electricity consumption data (available for 1-22 June), which points to about a 10-11% MoM improvement over May. Yet, current electricity consumption levels, a very good indicator of likely manufacturing activity, remain well below normal times, similar to what the CU rate suggests. Between 1-22 June, electricity consumption was down by 1.0% YoY, but when adjusted for the Bayram effect (as the Eid religious holiday was in June this year and in May last year), we see some 6% YoY deceleration.

Although this suggests that we remain far below previous production levels, there is still some improvement compared to the respective 15.4% and 16.7% YoY deceleration registered in April and May.

Real Sector Confidence Index

The seasonally-adjusted real sector confidence index also rose considerably to 89.8 in June from 73.5 in May and 62.3 in April. The welcome news is forward-looking expectations for production and export orders being significant, with the relevant index levels rising to a respective 120.4 and 113.0 from 82.1 and 83.2. We do not consider this outcome surprising either, given the inventory-pile up after two months of business shutdown/lockdowns.

Finally, as another timely leading indicator, credit card spending seems to have increased significantly in June, by some 17% compared to May (again adjusted for the Eid effect), and is now actually very close to levels realized prior to the pandemic. Yet, this may be partially attributable to pent-up demand, and its sustainability remains to be seen (independent from potential second-round contagion effect).

Economy bottomed out in April, but…..

All in all, it is certain (and unsurprising) that the economy has bottomed out in April, that and the sequential improvement has become more pronounced in June. That said, the sequential recovery is partially attributable to inventory pile-up and pent-up demand after two months of lockdown. We would still expect the sequential recovery to continue over the coming months, although the pace of recovery may somewhat decelerate, as time passes.

Serkan Gonencler

Economist, Seker Invest

You can follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/