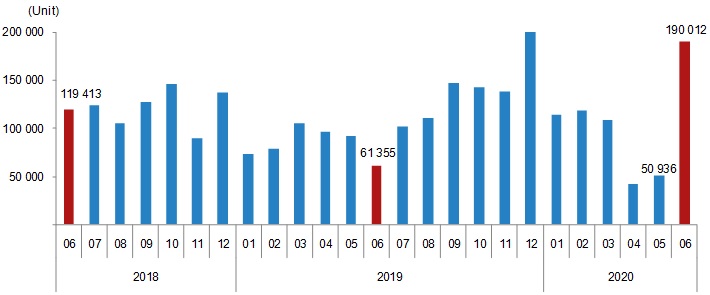

Turkey’s house sales skyrocketed by 209.7% yoy in June 2020 and reached 190K. The breakdown shows Istanbul had the highest share with 15.2%, followed by Ankara and Izmir with respective 11.5% and 6.2%.

The mortgaged house sales throughout Turkey boomed by 1,286.9% yoy and turned out as 101.5K as the share of mortgage sales increased to 53.4%. Other house sales also scaled up by 63.8% yoy and reached 88.5K.

First house sales showed an impressive 152.0% yoy spike to 58.6K accounting to 30.9% of all house sales in Turkey. Second hand house sales jumped by 245% yoy to 131.4K.

In the January-June period, Turkey’s home sales were up 23.5% to 624.8K while during the same term sales of mortgaged houses was 266.4K, rising by 221.4% yoy.

House sales to foreigners droppped by 38.1% to 1.7K in June.

The secret: Lower the rates below inflation, fuel state loans, penalize the private banks

Treasury and Finance Minister Albayrak said low interest rates took effect and housing sales last month reached the historical high recorded in any June so far.

Turkish state-lenders lowered interest rates for housing loans in June — 0.64% for new houses and 0.74% for second-hand houses — and extended loan’s maturity up to 15 years.

Hence, housing loan demand has increased rapidly. The housing loan volume of banks had increased by TL10.2 bn in the whole of 2019, and this number reached a record of TL18.9 bn in the three weeks of June 5-26.

While 90% of the increase was through public banks, only the housing loan increase in the week of June 19-26 was TL8.2 bn. The housing loan volume, which increased by TL34.6bn in three years covering 2017, 2018 and 2019; reached TL32.2bn in the January 1-June 26 period of this year.

The government has been providing ease of credit for citizens which are mostly practiced by state banks. The private banks that see dangers of extening higher volumes of loans are being penalized by the state. That is on 9 July, BRSA (Turkish banking sector watchdog) decided to impose a total administrative fines of TL204.7mn on seven banks. In the BRSA statement, the complaints made by individual and commercial customers were shown as the reason for the penalty.

The situation of course poses higher risks for the banks during a time when COVID-19 related lockdowns are adding to unemployment and the future appears bleak along with CPI inflation in Turkey at 13% yoy.