Turkey posted 7.4%, yoy GDP growth in Q321 and 2.7% qoq expansion when adjusted for calendar- and seasonal affects. The figures put 11% GDP growth for the whole of 2021 attainable.

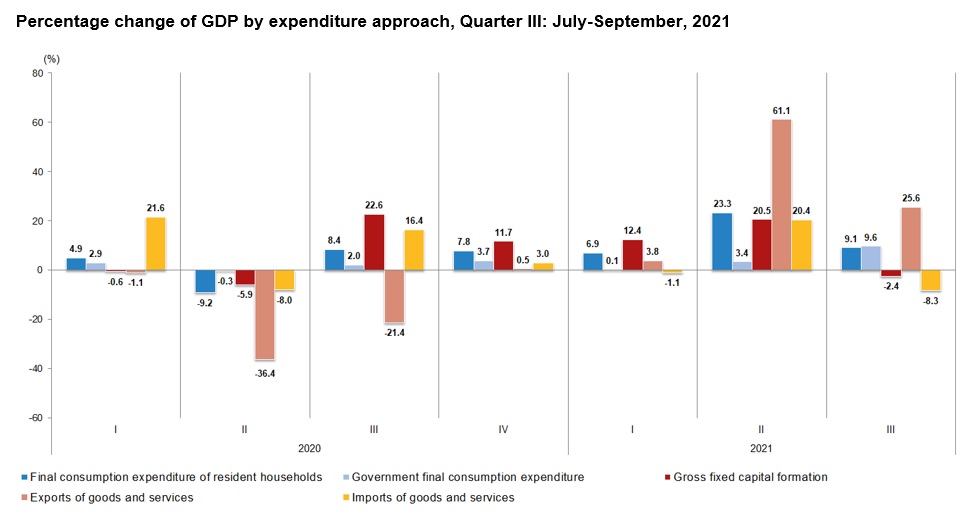

The details Q321 growth has roots in strong private consumption, and net exports while the contribution from public spending is also tangible. Then recovery of domestic consumption in 3Q over the 2Q is noticeable. The relative stability in TL through the summer months and the lifting of COVID-19 restrictions have worked wonders despite the higher interest rate environment. The expectations of higher inflation in the months ahead must have pulled the consumption demand earlier despite the weak consumer confidence observed during the period.

On the other hand, the election countdown seems to have triggered public spending which will be increasingly the case in the quarters ahead as private consumption is designated to fade.

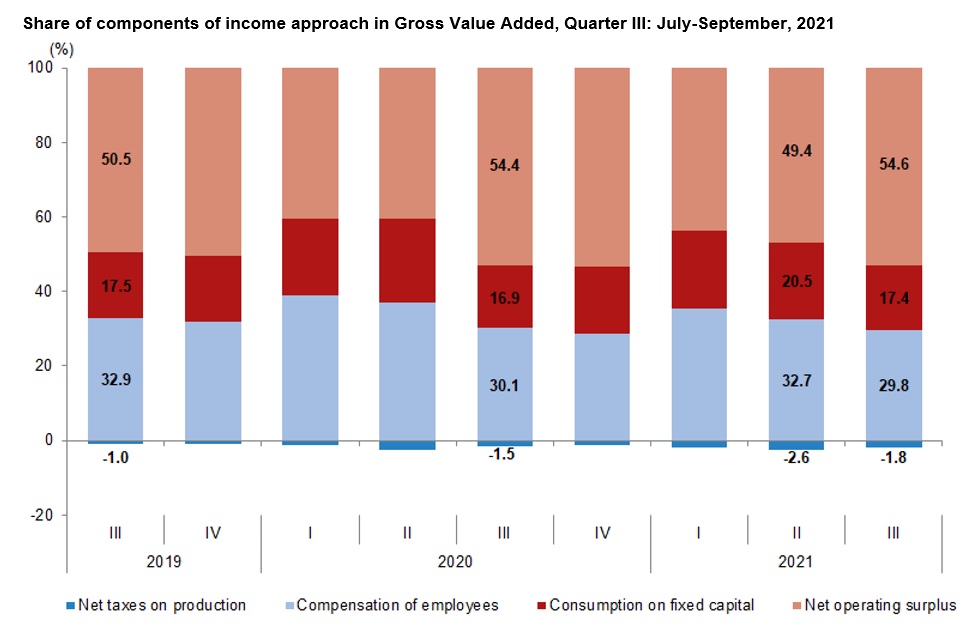

Turkey’s strong growth is not benefiting the crowds who are dependent on wages. The share of compensation of employees in the Gross Value Added (at current prices) eased down to 29.8% in 3Q compared to 35% right ahead of the pandemic. Yet the share of capital from the Gross Value-Added rose to 54.6% from 49% captured during the pre-pandemic quarter.

Looking at 2022, the TL’s ongoing depreciation and the accompanying high inflation is likely to outweigh the drop in the policy rate. Hence a recessionary environment looks more probable if not stagflation is set for 2022.