The Turkish Central Bank (TCMB) has quietly resumed its controversial “backdoor” foreign exchange (forex) sales, a recent analysis by Bloomberg said, raising concerns about transparency and economic stability despite recent changes in leadership and economic policies.

Since June, following elections and a shift in economic management, the TCMB had been making gradual changes to various regulations, aiming for greater transparency and stability in the country’s financial markets. However, undisclosed forex sales appear to continue unabated, causing apprehension among financial experts and the public.

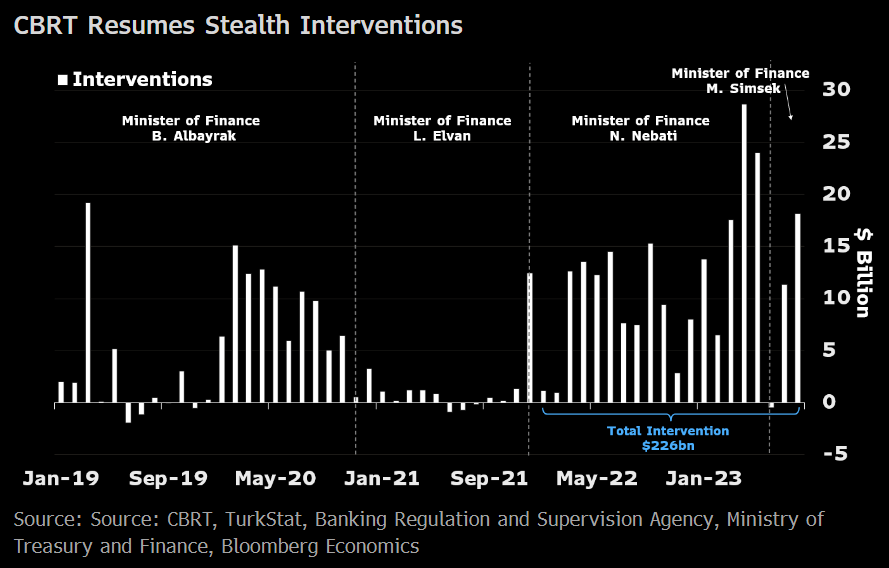

Economist Selva Baziki’s calculations, spanning from January 2022 to August 2023, revealed that TCMB’s “backdoor” forex interventions reached a staggering $226 billion over 20 months. This disclosure was made in a Bloomberg analysis article titled “Secret Interventions Resurface, Totaling $226 Billion,” which was published on the Bloomberg terminal.

The analysis highlighted that after a brief hiatus in “backdoor” forex sales when Gaye Erkan took over as TCMB’s head in June, these undisclosed operations surged significantly in July and August. During this period, despite the TCMB’s efforts to increase interest rates and implement other tightening measures, the Turkish Lira (TL) experienced a 5% depreciation against the U.S. Dollar.

Selva Baziki, commenting on the situation, expressed an expectation that TCMB’s forex sales would continue in the short term. He also noted that recent regulatory changes encouraging withdrawals from currency-hedged deposits might pose challenges to reserves in the future, potentially slowing down but not stopping the depreciation of the TL.

The analysis also reminded readers of the September announcement of the Medium-Term Program, which projected a 26% depreciation of the TL in 2024 compared to the 2023 average.

However, Baziki acknowledged that due to data limitations, his calculations were based on certain assumptions, and the actual figures could be lower or higher than the estimated $226 billion in “backdoor” interventions.

Despite promises of increased transparency from the new economic management after the elections, several key financial data points, including the amount of foreign exchange TCMB acquires and provides through the Currency Protection Mechanism (KKM), remain undisclosed. Likewise, the public has no access to information regarding the extent of currency losses or gains in the KKM.

Furthermore, data regarding the amount of foreign exchange received by TCMB from mandatory sales of export revenues, the currency obtained from those utilizing TL rediscount credits, and the foreign exchange acquired from the sale of real estate to foreign investors through the YUVAM program are also not publicly available.

Currently, TCMB employs five distinct sources to accumulate foreign exchange reserves, including direct forex purchase auctions, which had not been utilized for an extended period. Additionally, the central bank receives 40% of export revenue in exchange for Turkish Lira and collects forex from individuals and entities returning their forex to the KKM. TL rediscount credit beneficiaries’ forex sales and repayments also contribute to TCMB’s foreign exchange resources, as do foreign nationals’ real estate purchases through the YUVAM program.

While the Turkish Central Bank’s covert forex operations continue, questions about transparency, the impact on the Turkish Lira, and the implications for the nation’s economic stability persist, creating uncertainty in the financial markets and among the public. Experts closely monitor the evolving situation to assess the future trajectory of the Turkish economy.

Duvar