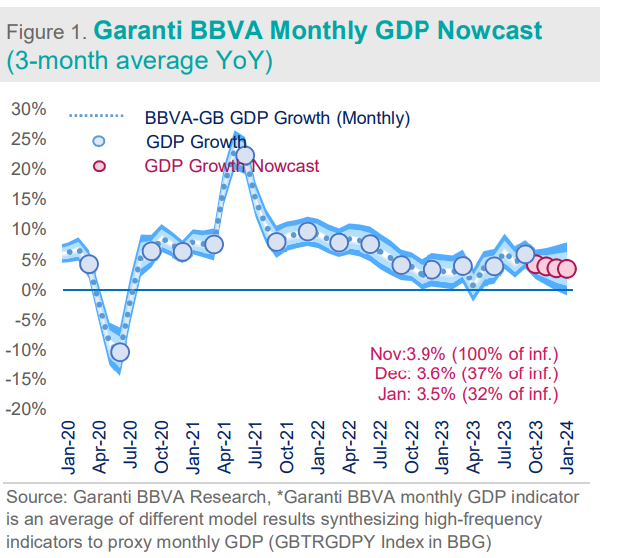

BBVA Garanti Invest publishes the only English language nowcast of the economy. Its February report states “We revise our activity impulse report to become a flash release at the start of each month. By the end of January, our GDP nowcast indicators signal a nearly stagnant quarterly GDP growth rate, which corresponds to an annual growth of 3.5%. We keep our 2024 GDP growth forecast at 3.5% after realizing nearly 4.5% in 2023”.

Highlights from the forecast are as follows:

The imbalance between demand and supply continues due to weaker production and ongoing strong demand.

On the supply side, industrial activity adjusts more negatively, while turnover indices in real terms indicate that activity in other sectors continued to deteriorate but much more slowly.

Investment demand weak, private consumption buoyant

Our GDP nowcasts on demand sub-components indicate that the private consumption has not showed any signs of further slow-down compared to Nov23. Instead, investment demand has continued to decelerate and resulted in an undesired outcome to support production capacity of the economy.

Private consumption continues to be mainly supported by goods component, particularly the durable goods, reflecting the need for additional monetary tightening in order to anchor inflation expectations.

Fiscal too loose for comfort

Overall financial conditions do not tighten further, while fiscal policy remains loose; which requires a clearer commitment to accelerate rebalancing in the economy and fight against inflation.

Our GDP nowcasts on demand sub-components indicate that private consumption (7.5pp) and investment (1.4pp) contributed totally 9pp to annual growth as of January, while the contribution of net exports (0.8pp) improved to the positive territory.

The current level of our financial conditions index signals somewhat an easing in overall conditions most recently (conditions are tight but it is still far from the level observed during 2018) which maintains upside risk on inflation outlook, given still solid domestic demand growing above the supply.

Compared to the delayed fiscal impulse coming from the gap between the Treasury cash and accrued Central Government budget deficit by the end of 2023 (at least 3% of GDP will be spent most likely in 1Q24), fiscal policy has already been loose, adding nearly 2.6pp fiscal impulse in the 4Q23 (1.9pp for the whole year).

The bottom line

Our GDP nowcasts on demand sub-components indicate that the private consumption has not showed any signs of further slow-down compared to Nov23. Instead, investment demand has continued to decelerate and resulted in an undesired outcome to support the production capacity of the economy.

In the recent weeks, there has been some stabilization in commercial credits; whereas consumer credits, particularly general purpose loans and credit cards, have gained momentum. This trend limited a further deceleration in consumption as signaled by our big data consumption indicators.

Private consumption continues to be mainly supported by goods component, particularly the durable goods, reflecting the need for additional monetary tightening in order to anchor inflation expectations.

Despite the seasonal factors at the start of the year, consumer credit card spending remains solid at around 1% weekly growth rate as of the last week of January. On consumer confidence, we observe a limited improvement in the overall index sine Jun23, led by more positive readings for future expectations.

Our external demand big data indicators signal the correction in imports has started to be seen more clearly in January, given the lagged effects of monetary tightening. The limited positive support from exports also helped and resulted in a positive contribution from net exports on growth for the first time since 3Q22.

Consumer goods import volume continued to decelerated despite preserving still high levels, while the contraction in intermediate and capital goods imports remained relatively limited compared to previous month, confirming the slight pick-up in production in January.

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/