Stratfor– Turkey Wavers Under the Weight of its Debt Load

Turkey’s economy has wavered on the edge of crises for the past several years, magnifying the impact of Turkey’s debt load. At first, a currency crisis in 2019 prompted a significant drawdown of the country’s foreign currency reserves to prop up the flagging value of the lira. After some replenishment in the intervening years, the central bank engaged in similar interventions in 2022 and early 2023 to support the Turkish lira, further drawing down reserves.

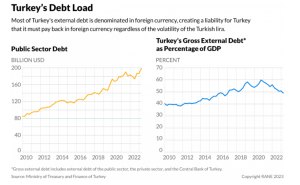

Most of Turkey’s external debt is denominated in foreign currency, creating a liability for Turkey because the country must pay back its debts in foreign currency regardless of the volatility of the Turkish lira. Following elections earlier this year, Turkey appears to be beginning a more technocratic strategy to try to stabilize its economy and reduce the liabilities of its debt load, but the sustainability and impact of this shift remain unclear, especially with political interference driving policy at the central bank.

SABAH: Turkish consumer confidence in economy down in July

Economic morale in Türkiye weakened in July compared to the month before, according to official data released on Friday.

The index fell 1.8% month-on-month to 99.3 in July, after a 2.5% decline in June, the Turkish Statistical Institute (TurkStat) data suggested.

The confidence index for retail trade dropped 2.6% from the prior month to 114.7 in July.

The construction confidence index fell 0.9% from a month ago to 88.1 in July, while the consumer confidence index plunged 5.9% to 80.1.

The services and real sector-manufacturing industry-confidence indexes edged down by 0.6% and 0.8%, to reach 117.3 and 104.9, respectively.

A rating above 100 indicates an optimistic outlook for the overall economic situation, while a value below 100 suggests a negative assessment.

Bloomberg: Turkey Dollar-Bond Rally Under Threat as Policy Pivot Drags

A rally in Turkey’s hard-currency bonds may falter without a more ambitious government tilt toward orthodox monetary policies, investors warn.

The country’s dollar sovereign bonds have returned 8.4% since the first round of voting on May 14, more than twice the average rate of those in other emerging markets, according to data compiled by Bloomberg. Meanwhile, Turkey’s credit-default swaps have tightened more than 300 basis points since the elections to below 400 basis points, the lowest since September 2021.

Investors had hoped a fresh approach by the central bank following President Recep Tayyip Erdogan’s election victory in May would lead to sharply higher interest rates and less use of reserves to prop up the lira. Instead, they say that progress has been disappointing.

“Given Turkey’s large external financing requirement, large current-account deficit and inadequate monetary policy, we expect the rally to slow down from here into August,” he said. Greer is underweight Turkish sovereign bonds and expects spreads to widen from current levels.

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: https://www.facebook.com/realturkeychannel