The Covid-19 pandemic, which is occurring globally and unsettling the whole world, affects the pharmaceutical industry in many ways as it has been case for almost all other sectors as well. The pharmaceutical industry, which has been prominent as one of the most important sectors in this period, increases the production of certain medicines in order to control the epidemic and to treat the damage caused by this virus in the human body, but at the same time continues to intensively research studies on the vaccine for the protection from the virus and on drugs for the treatment of the virus. Some negative developments occurred during this pandemic, which haven’t been experienced before, have made the sector’s development difficult to predict in 2020.

Industry data

The total turnover of the Pharmaceutical Sector in Turkey grew by 31.7% and reached TL40.7 billion in 2019 after a 26.1% increase in 2018. In addition to the 26.4% increase in the Euro rate which was used to determine drug prices and was applied as TL3.40 by February 19, 2019, the rise in the volume of boxes sold was also effective in this growth. According to the data of the Pharmaceutical Manufacturers Association of Turkey (PMAT), drug sales in Turkey grew by 3.0% in terms of volume and rose to 2.37 billion boxes in 2019.

The Euro rate was determined as TL3.82 by increasing 12.1% on February 18, 2020. In this respect, total turnover is expected to grow by a minimum of 12.1% in 2020 to reach TL45.6 billion in case of maintaining the volume of boxes sold at the same level. However, while the demand for drugs for a number of treatment groups increased during the Covid-19 epidemic, it is predicted that the volume of boxes sold throughout 2020 will decrease as a result of the slowdown of new disease diagnoses and new prescriptions.

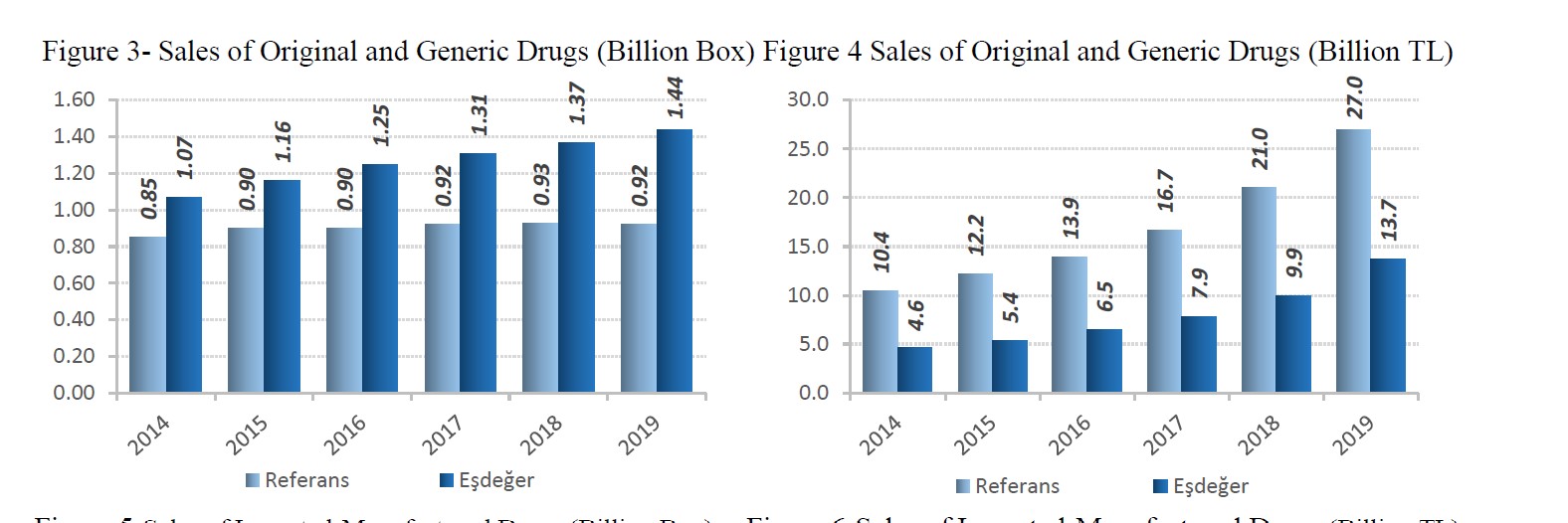

The total turnover of the sector, amounting to TL40.7 billion in 2019 according to the producer prices, consisted of TL27.0 billion of original drugs and TL13.7 billion of generic drugs. The turnover of original drugs grew by 28.6%, and the sales revenue of generics increased by 38.3%. In terms of the volume of sold box, generic drugs increased by 5.1% to 1.44 billion boxes, while original drugs contracted by 1.1% and decreased to 920 million boxes. As original drugs constitute 66.2% of the turnover of the sector, its share in the volume of sold boxes is 39.0%. While the average box selling price of original drugs was TL29.35, this price for generic drugs was only TL9.51. Although generic drugs constituted 61.0% of the volume of box sold, their share in total turnover remained at 33.8% owing to low sales values.

Weakening currency poses problems

Due to high increases in the exchange rates since the second half of 2018, the difference between the current exchange rate and the Euro rate has widened. As a result of this, a number of drugs imported to Turkey faced difficulties due to the decrease in their profitability. On the other hand, with the effect of the studies carried out to produce a good number of imported drugs in Turkey, the drugs manufactured domestically got ahead of the size of imported drugs in the sector sales for the first time in 2019. While the turnover of domestic manufactured drugs grew by 42.3% and reached TL21.2 billion, the increase in imported drugs was 21.9% and the turnover rose to TL19.5 billion in this period. Thus, 52.1% of the sector’s turnover has been domestically manufactured, while the imported drugs receded to 47.9%. As the volume of domestic manufactured drugs in terms of box sold grew by 7.8% and reached 2.07 billion boxes, the shrinkage was experienced in imported drugs by 23.7% and 290 million boxes were sold only. So that, 87.6% of the volume of box sold was domestically manufactured and 12.4% was imported drugs. The average box sales price of domestic production drugs grew by 31.0% to TL10.24, while the price increase in imported drugs was 59.7% and reached TL 67.24.

Pharma during Covid-19 and beyond

Due to the problems in the supply chains during the initial period of the Covid-19 pandemic, a set of difficulties occurred in the importation of drugs brought mainly from abroad by air ways. However imports started again with alternative transportation methods in the upcoming weeks. In addition to the problems in the supply chain, increasing exchange rates also caused a decrease in the profitability of some imported drugs. In the light of these developments, a contraction in the sales volume of imported drugs is expected throughout 2020.

Approximately 80% of the raw materials used in pharmaceutical production in Turkey are imported. Despite the growth in the exports of the sector, the foreign trade deficit generated by the sector is at high levels due to the foreign-dependent character of the production. While the exports of the pharmaceutical sector increased by 10.0% in 2019 to USD1.44 billion, its imports grew by 8.4% and reached USD5.56 billion. The ratio of exports to imports, which was 25.6% last year, increased to 26.0%.

Exchange rates, which reached high levels again during the Covid-19 pandemic period, further increased the difference between the exchange rate used in drug pricing and the current exchange rate, reducing the profitability of the manufacturers. Along with the foreign trade which slowed down during the pandemic , the foreign trade restrictions imposed by countries on health products and the problems in the supply chain are other factors that will adversely affect the sector. Therefore, a decrease is expected in both exports and imports. In addition, due to the fact that the raw materials used in production are mainly imported from China, there will be problems in the supply of raw materials as a result of slowing production in China during the pandemic. Alternative and new suppliers will cause the costs of the producers to increase.

Personal healthcare products, including preventive healthcare products, vitamins and immune-enhancing supplements, which are prominent in the pandemic period, are considered to be one of the most important groups in the pharmaceutical industry in the upcoming periods. The sales volume of these products is expected to grow by 40.0% globally. In addition, the sales prices of these products are determined by the manufacturer or distributor companies under free market conditions due to their non-drug status. Because of this feature, it is expected that personal healthcare products, which stand out with their profitability, will reach a very important position throughout the sector.

You can follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/