In the week of August 9, the USD4.6 billion decrease in the CBRT’s net FX reserves excluding swaps, the USD18 million purchase of GDDS by non-residents and the USD2.8 billion increase in FX deposits are particulary noteworthy. The weekly movements can be summarized as follows:

Euro/dollar cross rate adjusted FX deposits increased by approximately USD2,844 million, with USD2,104 million in purchases for corporates and USD740 million for individuals. Consequently, FX deposits have declined by USD22.2billion since the week of March 29th, with USD11.7billion of this decrease coming from individuals and USD10.5 billion from corporates.

FX-protected deposits (KKM) decreased to TL1,693 billion with a weekly outflow of TL49.3billion (USD1.7billion). Since the peak in August 2023, KKM accounts have decreased by TL1.693 billion (USD 84.5 billion).

The share of FX deposits + KKM in total deposits increased from 48% to 48.2% WoW. Note that the share of FX deposits and KKM accounts in total deposits had peaked at 68.4% in August 2023.

TL deposits increased by TL 19 billion weekly and reached TL10.5 trillion.

FX loans increased by 0.5% WoW, or by USD 0,8billion, bringing the total increase since the end of March to 17% (USD22.7billion), and reaching USD157.4billion.

Looking at the annualized 13-week average loan growth, commercial loans decreased from 27.3% to 26.7%, while consumer loans increased from 29.4% to 31%.

Net foreign inflows into government domestic debt securities (GDDS) was USD18 million, with the final balance reaching approximately USD13.4 billion, while the outflow from equities was USD323 million, with the final balance standing at USD36.1 billion YTD. Consequently, net purchases in GDDS reached USD11 billion, while net sales in equities reached USD1.6 billion YTD.

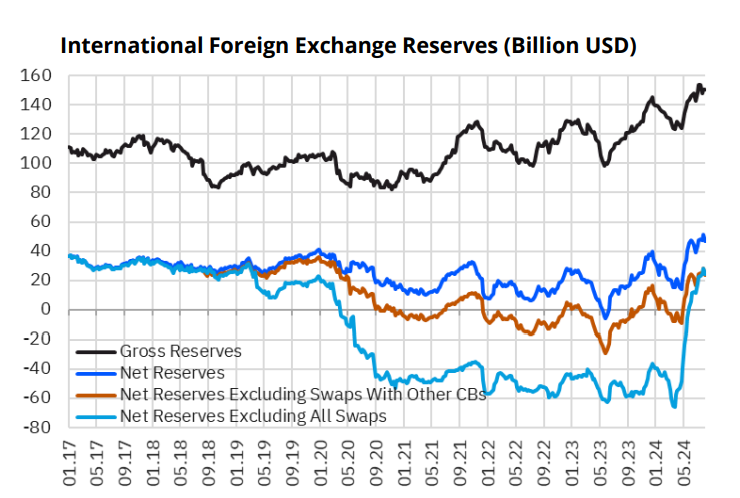

In the week of August 9, gross reserves decreased from USD150.4 billion to USD150.2 billion. In the same week, net reserves increased by USD4.6billion from USD51.5billion to USD48.9 billion. Moreover, net FX reserves excluding swaps also decreased by USD3.8 billion to USD24.5 billion. Note that there has been some USD90billion improvement in net FX reserves excluding swaps since end-March from the trough level of -USD65.5 billion.

By Gedik Investment research reports

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/