Once again, Turkey is in the throes of a currency crisis. The lira has lost more than 40 percent of its value against the United States dollar this year, making it the worst-performing of all emerging market currencies.

In November alone, the lira lost nearly 30 percent of its value against the dollar – landing it well into currency crash territory.

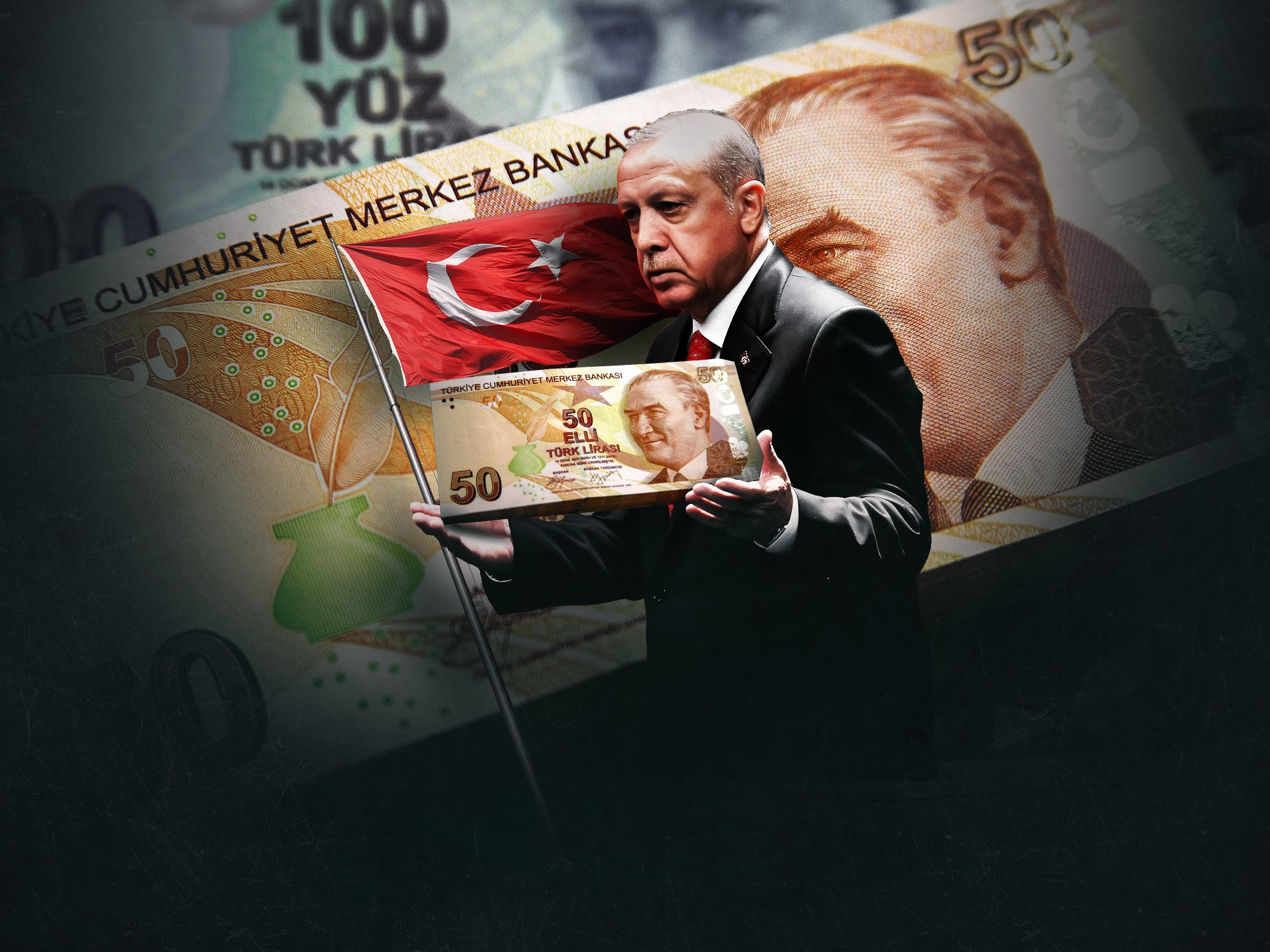

The rapid slide has ushered in a wave of dollar hoarding, and even witnessed the unusual sight of people taking to the streets to protest President Recep Tayyip Erdogan’s handling of the economy.

For his part, Erdogan has blamed the lira’s troubles on foreigners and their supporters in Turkey.

So why is the Turkish lira crashing? Is it due to Erdogan’s policies? A foreign conspiracy? And is the worst yet to come?

Here’s the short answer.

Why did the lira crash?

The lira’s recent troubles were triggered after Turkey’s central bank cut interest rates by a full percentage point on November 18th – the third cut since September – and signaled it would slash rates again in December.

What is the relationship between interest rates and a currency’s value?

When a central bank lowers interest rates, money generally becomes less expensive to borrow and therefore less valuable relative to other currencies.

Is that always a bad thing?

Not when inflation is low and you’re trying to kick-start economic growth. Generally speaking, low rates encourage consumers to borrow more to buy things, and businesses to borrow more to expand operations and hire new workers.

OK, so why was the lira punished when Turkey slashed interest rates in November?

Because inflation is anything but low right now. Economies all over the world are getting squeezed by price pressures due to supply-chain bottlenecks and shortages of raw materials. Turkey is no exception.

How bad is inflation in Turkey?

In October, annual consumer price inflation in Turkey was running near 20 percent. Yet the country’s benchmark interest rate currently stands at 15 percent after the central bank slashed borrowing costs by four full percentage points since September. And when you cut rates when inflation is high, more inflation is almost surely bound to follow.

Are other emerging economies following Turkey’s lead and cutting interest rates in response to inflation?

Actually, quite the opposite. South Korea, Russia, Brazil, Mexico and Hungary have all raised interest rates to try and keep a lid on inflation.

So who is in favour of Turkey raising interest rates to battle inflation?

President Erdogan believes that lower rates will fight inflation, boost economic growth, power exports and create jobs.

Is Turkey’s economy growing?

It is. Turkey’s economy grew 7.4 percent in the third quarter compared to a year earlier. Exports were especially strong.

So does that mean Erdogan is right?

While healthy economic growth suggests living standards should improve for Turks, unfortunately, that’s not happening because of soaring inflation.

Are there other pain points?

Turkey’s economy is also very dependent on external financing, which means that businesses that took out debts denominated in dollars are facing steeper repayment costs as the lira loses value against the greenback.

Will the economy keep growing, at least?

Some analysts see Turkey’s economy actually shrinking in the fourth quarter of 2021 because of the lira’s troubles.

“A sharp contraction is likely in Q4 as the effects of the sharp falls in the lira in recent weeks – which have left it more than 20 percent lower than at the start of September – filter through to the economy,” Jason Tuvey, senior emerging markets economist at Capital Economics, said.

Is that really Erdogan’s fault? After all, it’s the central bank that cuts rates, correct?

Central banks do set interest rate policy. But Erdogan has sacked three central bank chiefs over the past two years – and has given pink slips to other central bank officials.

So, is the lira suffering from the central bank’s revolving door?

Yes. Because when central banks appear to lose their independence, investors get jumpy. They worry that political goals will determine a country’s interest rate policy, rather than economic fundamentals.

So what does Erdogan say about the lira crash?

Erdogan says the lira’s troubles are the result of foreigners sabotaging Turkey’s economy as well as their supporters within the country. In a speech on November 22, he declared an “economic war of independence”, which he vowed Turkey would win.

How did that speech go over?

In currency markets at least, it triggered a free fall in the lira, which briefly touched what was then an all-time low of 13.45 to $1. Tuvey of Capital Economics wrote at the time that Erdogan “seems intent on testing out his unconventional monetary policy views”.

Are there other factors at play working against the lira?

The lira has been more or less in a steady decline since Turkey’s last currency crisis in 2018.

In addition to the central bank’s interest rate cuts this year in the face of rising inflation, the lira has also suffered from dwindling foreign exchange reserves and ongoing tensions between Ankara and Washington.

Is the worst of this lira crisis over?

The rest of the article is here.